Listen to our podcast episode on the most popular types of luxury jewellery at high-end pawn shops:

1. Pawn Your Diamond Earrings

Earrings created from precious metals and gemstones have been decorating our bodies since ancient times. In days gone by, only the noblest or royal individuals had the funds to buy and wear them, explaining the high cost of some jewellery, rings, and other diamonds at auctions, and pawn shops. Nowadays, many of us have diamond earrings tucked away in our jewellery boxes. We wear them casually as well as formally. Sometimes we keep them hidden away and hardly ever wear them at all. That is when it makes particular sense to consider their capital value.

We only need to look around us to see those diamond earrings come in a huge range of sizes and styles, from studs to elegant drops and eye-catching diamond hoops. Perhaps they are sleek and modern, or maybe they are antique and have dropped from the ears of princesses and queens. The diamonds themselves each come with a unique history and character, which often increases their value at pawn shops. Sometimes they are mounted in gold, sometimes in platinum. Maybe they are sparkling round brilliant cut diamonds. Or, perhaps, they are European old-cut diamonds with irregular facets or flaws.

There are literally endless options to consider. That makes it impossible for our fine jewellery pawnbroking team to give you a loan value for your diamond earrings without seeing them first. A pair of good quality but simple diamond stud earrings might have a market value of £300. Large, rare diamonds mounted in white gold might sell for many tens of thousands of pounds.

For example, in 2017, a pair of non-matching pink and blue pear-shaped diamond earrings named after twin deities Apollo and Artemis sold for a combined US$57.4 million at Sotheby’s in Geneva. They were sold separately but to the same buyer. The 14.54-carat blue diamond fetched over $42 million and the pink went for over US$15 million.

2. Pawn Your Diamond Necklace

Diamonds are without a doubt luxurious precious stones, but they come in varying degrees of quality, which affects their price at auction. Factors from the size to the purity of a stone can make a diamond necklace’s value fluctuate at pawn shops, meaning an expert eye is essential to getting a fair loan price.

To illustrate this fluctuation, note that ‘The Farnese Blue’ diamond was sold for an amazing $6,713,837 in 2018. It was a rare appearance having been kept within various royal families for years before. This meant very few even knew it existed, placing it as one of the most expensive pieces of jewellery ever sold. However, it is possible to purchase diamond necklaces for several hundred pounds if the carat and purity are lower, hence their value will be lower when pawning it.

Valuing your Diamonds necklace

Diamonds, no matter the type of jewellery they’re incorporated in i.e. expensive rings, necklaces, etc, are assessed at pawn shops according to the ‘Four C’s’. Understanding these in more detail will help you to understand more about the appraisal process:

1. Clarity:

As diamonds are formed naturally rather than created in a factory, lots of them have flaws. These can be surface blemishes, which are made up of things like chips, cracks, or marks. Depending on their severity, they can be difficult to see. It can be harder to know whether your diamond has internal defects, which are called inclusions. These might be because of impure materials that have become trapped within the diamond or air bubbles – implicitly, these flaws vs. purity levels will determine the loan value of your diamond necklace at pawn shops.

2. Cut:

Diamonds need to be properly cut in order to maximise the amount of sparkle and shine they emit. Classifications come in a range, with the ideal being the best and poor the worst. In the middle, there is a range from excellent to fair.

3. Colour:

Although you might think your diamond is colorless, completely colorless diamonds are exceptionally rare and priced very highly. Most diamonds that seem colourless have in fact varying shades of white or yellow within them. The closer to colourless your diamond is, the better it will reflect light, and the higher the necklace value it is mounted on will be at pawn shops. However, noticeably coloured diamonds, for example, orange or pink stones, are also very rare, meaning they’ll also raise a higher loan.

4. Carat:

Carat refers to the weight of diamonds, with higher carats being of a greater value as the stones are bigger – the higher the carat value, the higher the borrowing against the necklace it is mounted on. However, larger stones that are less pure or have other defects could be worth less than smaller stones that are of exceptional quality.

3. Pawn Your Diamond Ring

As we saw earlier on in this post, diamonds are priced according to the ‘four C’s’, which are carat, clarity, colour, and cut. Although diamonds are always considered a luxury and are typically high in price, value at auctions and pawn shops varies widely depending on the gem’s quality.

For example, in 2018, the world record for the highest-priced pink diamond (per carat) at auction was broken. It was Christie’s that sold this particularly rare piece, a diamond named ‘The Pink Legacy’ that went for more than $50 million. Boasting 18.96 carats and exceptional purity of colour, it’s a much sought-after collector’s piece.

Many people choose to sell or pawn their engagement or wedding rings as a solid way of securing much-needed capital. Typically an engagement or wedding ring will hold a significant amount of value, and can therefore be used for a loan, or can be sold as an alternative option.

Pawnbrokers will consider various criteria when valuing your engagement or wedding rings. This includes the type of gemstones, where your engagement or wedding ring was initially purchased, who the manufacturer is, what type of documentation you have, how much it was purchased for, what the market value is for your jewellery, how much similar pieces have sold for, what type of metal the ring is made from, and how bespoke or desirable the design is.

In some cases, your wedding or engagement ring may not be worth as much as you expect from pawn shops, particularly if it is a very common or trend-led piece. For antique jewellery, bespoke or one-off pieces, you may be able to command a lot more.

4. Pawn Your Actual Diamonds

![]()

There are a variety of diamonds you can loan against, but generally, pawnbrokers categorize them in the following types and cuts:

2 CARAT DIAMONDS

The worth of your 2-carat diamond at pawn shops will likely fall somewhere in the range of $8,000 to $50,000. This is a large range because the higher end of the scale will be reserved for diamonds that are cut perfectly and flawless in clarity, as well as potentially being a rare colour.

2. BAGUETTE CUT DIAMONDS.

Baguette-cut diamonds are valuable and popular, often being used in jewellery, so they’re a great asset to borrow funds against. The bold, rectangular outline encasing terrace-like cuts and facets creates an incredible effect. So, what is the financing amount you can get on your baguette cut diamonds?

Most pawnbrokers will be able to give you an accurate valuation on your diamond at their stores, but overall, we always find that baguette diamonds do raise sizeable credit. For example, in 2018 a ring with a rare 10.68-carat lozenge-shaped Columbian Classic emerald and a baguette-cut diamond sold for $1.2 million at Sotheby’s – calculate 70% of this price, and you will quickly get an initial understanding of the sum you would raise by pawning your baguette diamond.

3. BLUE DIAMONDS

Blue diamonds are rare, expensive, and in high demand due to their natural colour, hence they can be a great idea if you try to avoid losing ownership of it. They are formed when there are boron particles and the particles are trapped in the diamond’s lattice form. Boron as an element absorbs yellow light naturally, therefore making the diamond reflect a blue colour. It’s difficult to tell the worth of a blue diamond without expert valuation, although darker blue diamonds often fetch more at auction. The Blue Moon of Josephine, for instance, sold at auction in 2015 for £37,396,080.

4. CUSHION CUT DIAMONDS

This is a fascinating cut that is square but has round corners, and it faces upwards so it looks a bit like a bigger diamond from above. In one particularly crazy story, someone bought a cushion cut diamond at a London junk sale for just £10 as it was thought to be a piece of costume jewellery. They later sold it for £657,000 at Sotheby’s. Loans on cushion cut diamonds vary like all others.

5. EMERALD CUT DIAMONDS

Only about 3% of diamonds in the whole world are Emerald cut. They’re a unique type, admired for their vintage look and cut that makes them sparkle differently from the round cut variety.

6. FANCY COLOUR DIAMONDS

Like the emerald cut, fancy colour diamonds are rarer than your more common round cut, and lending against it is likely to be high, even if it’s a low carat. The most expensive fancy colour diamond sold to date was the pink star, which went for $71.2 million in 2017.

7. MARQUISE CUT DIAMONDS

Marquise cut diamonds have a luxurious appeal – it’s a smooth, curved cut with pointed ends and its 58 facets give this diamond an exceptional finish. In history, marquise diamonds have been used in fine jewellery, and fetched considerable funds when sold on. For example, the Anonymous Diamond Necklace contained a line of 24-carat marquise diamonds and sold at auction for £352,188 in 2011.

8. OLD CUT DIAMONDS

In the early days of gem cutting, diamonds were shaped differently and reflected little to no light. It meant they appeared black, in the past being valued for their hardness and drawing the eye into their depths over anything else. This means the three types of old cut diamonds – Old Mine Cut, Old European Cut, and the Rose Cut are all quite different from many other diamonds.

9. OVAL CUT DIAMONDS

As they are highly valuable, sometimes oval-cut diamonds can often access loans far larger than clients want or need to borrow. For example, back in 2013, an oval cut diamond, which was colourless, sold for a tremendous $30.6 million in Hong Kong.

9. PEAR CUT DIAMONDS

We understand that pear-cut diamonds can mean so much more than just their monetary value. An exquisite combination of round and marquise cut diamonds with between 58 and 72 facets, they are gracefully beautiful.

10. PINK DIAMONDS

Diamonds with a pink or red colour to them are some of the most in-demand gemstones in the world, meaning you will release significant capital by either selling it, or by pawning it. Only 0.1% of diamonds mined each year tend to be pink ones, so their extreme rarity also adds to their value. Pink diamonds are also mysterious. There’s a scientific explanation for most other coloured diamonds, but since pink ones don’t contain any impurities, scientists have struggled to understand what gives them their colouring. One potential explanation is they have a molecular difference.

11. PRINCESS CUT DIAMONDS

Princess-cut diamonds often command a high level of borrowing, as this cut of diamonds is the second most popular after the round cut. Princess cut diamonds were first created recently, during the 1960s, and have four corners rather than rounded edges.

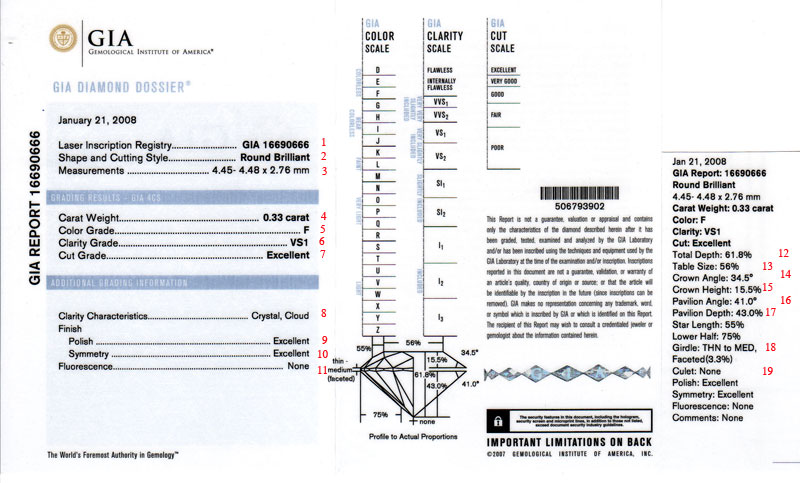

12. GIA CERTIFIED DIAMONDS

Most pawnbrokers prefer GIA-certified diamonds as a way of securing a loan. A GIA-certified diamond is a diamond that has been graded by the Gemological Institute of America (GIA), which has a London base in Bloomsbury.

VALUING YOUR DIAMOND JEWELLERY COLLECTION

When appraising jewellery and precious stones before lending against it, pawnbrokers consider the following:

MANUFACTURER

Brand or manufacturer is naturally very important when pawning your diamond jewellery, along with whether the jewellery piece you will borrow funds against bears a signature. Among many others, we will consider lending on pieces from classic and contemporary jewellery houses such as: Boodles, Graff, Bvlgari, Van Cleef and Arpel, Cartier, Tiffany and Co., Shaun Leane, Stephen Webster, Boucheron, Buccellati, Chaumet and Lalique.

MATERIAL

Customers can pawn many styles of fine jewellery featuring diamonds, including earrings, necklaces, rings, and broaches. Small variants can make a significant difference to the value and require expert perception to detect. Diamonds in antique and collector’s jewellery also require an understanding of the desirability of the overall piece and how often similar pieces come up at auction houses. As with everything, the less availability there is of a certain brand or era of jewellery, the higher it is likely to fetch when pawning or selling it. Precious metals and gemstones in fine jewellery will also determine their loan value as outlined below:

- Platinum is one of the rarer elements and only comes in one recognised chemical composition, making it the most valuable of all precious metals.

- Gold is determined in value by the amount of gold in the actual metal, which can range from a low 9ct to as high as 24ct. The higher the carat, the more the gold jewellery is worth for pawning purposes.

- Types of precious stones in fine jewellery: diamonds, rubies, sapphires, and emeralds are considered the 4 most desirable of precious stones, hence valuable lending can be achieved against it.

GEMSTONES

There are many contributing factors that help us establish the value of precious gemstones jewellery before releasing a loan offer. Some gemstone characteristics like weight are tangible; others like clarity, colour or origin can be less straightforward to determine.

Many fine gemstones, especially diamonds, are now accompanied by a laboratory report listing the colour, cut, clarity and weight. They may also contain information about treatments or origin.

While they may not always be entirely necessary for the loan valuation process, pawn shops consider the following laboratory certificates to be of the highest standard when financing your jewellery: GIA – Gemological Institute of America; HRD – Diamond High Council; and Gem Lab – Gubelin.

Certain jewellery gemstones, such as ruby, sapphire, or rare natural gems, can attract a premium loan value in the market if they can be traced to a particular country. In lieu of an independent grading report, the seller may offer certain guarantees.