I hope you enjoy this blog post.

If you want us to appraise your luxury watch, painting, classic car or jewellery for a loan, click here.

How to Invest in Wines: What should you know in 2024?

Best wines to invest in 2024?

Interestingly, fine art, classic cars, handmade watches, and chronographs, especially of Swiss origin are the things that most likely come to mind when thinking about buying prestige items at auction. Of course, these are truly wonderful creations that can command incredibly high sale prices and transform your investment portfolio.

But there is one investment alternative that is almost criminally overlooked, and that is fine wine. In fact, the best wines to invest in 2024 may bring you a much better ROI margin than many more volatile assets like luxury phones.

Often sorted into the ‘alternative’ category when it comes to investing in desirable objects, along with rare coins, stamps, and other curiosities, wine has in 2024 become increasingly popular for collectors and investors.

In fact, the popularity of wine investment started as early as 2018, when the record for the most expensive single bottle of wine was surpassed 5 times.

WINE INVESTMENT MARKET ANALYSIS FOR 2024

Wine as an investment is a way to combine your passion and interest in wine while making money on the market. After years of slow and steady success, the wine investment market shot up dramatically in mid-2020. Pandemic-related financial turmoil in the market led investors to explore alternative assets, heating the space to record heights by late 2022.

However, for most investors, 2023 was as musty and lackluster as a corked bottle. Prices fell as market players liquidated their holdings. As the year wore on, prices kept on dropping, with experts unsure when the carnage would halt.

Everyone associated with the fine wine for investment market will look upon 2024 with great interest to see if it will be a vintage year or an annus horribilis.

That’s the high-level overview. However, if we truly want to understand what will happen in 2024 and beyond, we need to dig a bit deeper. Here is our comprehensive wine investment market analysis for 2024.

A DEEP ANALYSIS OF FINE WINE FOR INVESTMENT

At the dawn of 2024, prices in the fine market have settled down to 2021 levels. Economic uncertainty and political instability are typically poor signs for luxury goods, including fine wine to collect for investment.

So, before we share the best wine investments you can make in 2024, let’s explore some important factors, such as historical returns, liquidity, and where the market is going in the future.

| Index | Five-year return |

| Liv-Ex Fine Wine 50 | -2.4% |

| Liv-ex Fine Wine 100 | 15.2% |

| Liv-ex Fine Wine 1000 | 11.9% |

| Liv-ex Bordeaux 500 | 3.3% |

| California 50 | 8.7% |

| Port 50 | -4% |

| Bordeaux Legends 40 | 3.4% |

| Burgundy 150 | 21.7% |

| Champagne 50 | 48.4% |

| Rhone 100 | -4.5% |

| Italy 100 | 31.5% |

| Rest of the World | 6.5% |

So, even after the massive 11% market correction over the last few years, only the Liv-ex 50, Port 50, and Rhone 100 are down. The other major indexes have performed positively in that time.

What should also stand out to investors is that while the Liv-Ex 50 has underperformed, the Liv-Ex 100 has not. So, these wines between 50 and 100 on that list are doing a lot of heavy lifting, making them some of the best wine to invest in over the last few years.

Aside from that, these five-year figures help underline the importance of setting long-term horizons in your investing so you can eat the variance and come out ahead.

1. CAN WINE INVESTMENT RETURNS BOUNCE BACK IN 2024?

The big question on investors’ lips in 2024 is, “Will wine investment returns bounce back?” For newer entrants to the market, 2023 was most likely a disaster. If the broader investment-grade market wants to grow, it can’t scare off investors via bad performance.

The difficulty is that for the first time in 15 years, wine underwent a serious correction. However, veteran wine investors will remember the post-Financial Crash era that hurt collecting in 2008.

After Lehman Brothers went to the wall, the fine market took a hit. Respected wine critic and writer Jancis Robinson said at the time:

“Many a banker and hedge fund manager has liquidated his fine wine investments, flooding the market with, typically, 2005 Bordeaux first growths whose prices have been tumbling, but were surely unsustainable anyway.”

That sharp drop continued into 2009 but rallied strongly and hit market highs in 2011 that was not surpassed for more than a decade. However, those dizzying heights dropped that year, and 2011 featured an unprecedented 15% decline.

It was a long road back for fine wine then. But investors must remember that the circumstances were different.

Firstly, it was a global financial crisis. While growth is currently slow, experts say we aren’t in a recession. Secondly, one of the biggest drivers of the 2011 peak was the Asian market. However, anti-corruption measures in China removed a chunk of investors, and over the next three years, the Liv-Ex 100 declined by a staggering 36%.

It took the market some time to regain confidence in investment-grade wine. It took even longer for pensions and mutual funds to get involved with the grape again. The takeaway for investors here is that while this is a correction, it wasn’t the end in 2008 or 2011, and it won’t be the end in 2024 either.

2. WHAT IS LIQUIDITY LIKE IN THE FINE WINE INVESTMENT SPACE IN 2024?

So far, we’ve mostly been focused on what you can do to get involved in the fine wine investment space as a buyer. However, that’s just one part of the equation. It’s all well and good if prices go up, but if the market lacks liquidity, you can’t exit at the right point and realize your profits.

So, what is liquidity like in the fine wine stock market? Again, it’s complex.

Liquidity in the fine wine investment space in 2024 is dependent on a few different factors. Firstly, we should make clear that wine doesn’t have the same volumes as the equity market. So, cashing out your investment is a bit more complex.

In recent years, the rise of online trading platforms and wine marketplaces has improved that situation, but investors must understand that liquidation of your assets can take weeks or much longer for more obscure bottles.

Obviously, a lot still depends on things like vintage, producer, and rarity of a bottle. Ultra-rare collector’s items, like premier Bordeaux bottles, are still subject to strong demand. But, as we’ll show below, even Burgundy wines are more difficult to shift than they were in a few years ago.

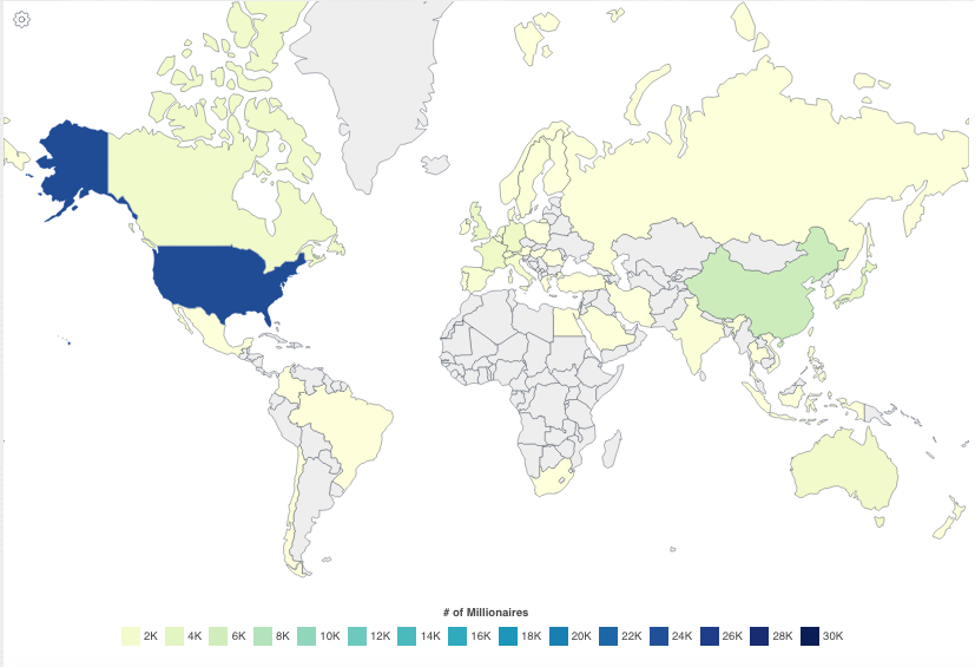

That said, while demand may have softened in the Western world, there is a new era of global millionaires emerging.

Depending on whose statistics you believe, there are between 47 and 60 million global millionaires in the world. While a good chunk are concentrated in the US, this is changing rapidly.

3. WINE INVESTMENT: THE FIVE-YEAR VIEW

Fine wine as an investment class works best over the long term. The thing to remember is that we’re dealing with a limited product. As people drink cases or bottles are bought by investors without the intention to sell, the available supply is removed from the market. When a vintage is good and earns a solid reputation, demand can skyrocket. But these dynamics typically happen over longer horizons.

While the market may have experienced a challenging few years, looking at what is happening over the long term is essential.

Per Liv-Ex, the five-year performance for wine investment returns as of February 2024 is as follows.

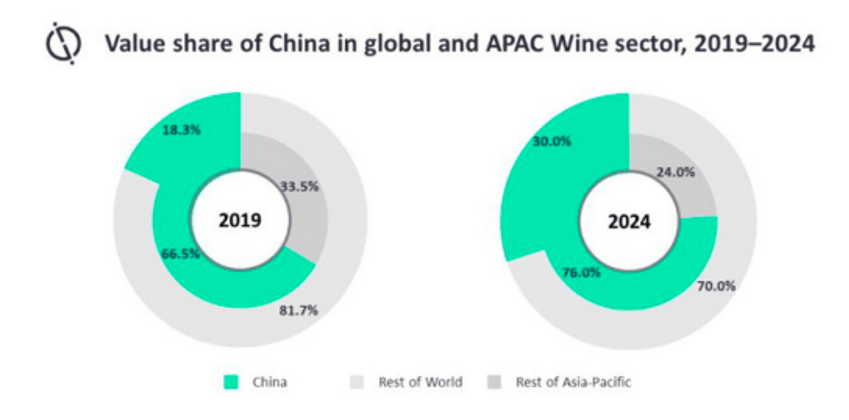

China has exploded back onto the scene as a buyer of investment-grade wine, even if the general wine-drinking population has decreased.

Since around 2009, China has accounted for about 75% of APAC wine market imports and 30% of total global imports. It’s a huge market that can provide welcome liquidity for sellers. However, the collapse of the Chinese housing market last year should give investors some pause about banking on returns from the region.

However, the other BRIC nations — Brazil, Russia, and India — have also shown an appetite for the best wine investments.

It’s important to remember that the BRIC nations make up about 45% of the world’s population. The finest wine producers rarely expand their production to scale out more bottles. There are hard limits designated by land ownership, regulations, and even producers’ preferences. As demand increases in these emerging countries and their share of global billionaires increases, we can expect to see prices rise once more.

2024 WINE MARKET INVESTMENT TRENDS

Before we talk about the different ways of investing in wine companies, let’s explore the big trends that will decide the market in 2024.

1. MONEY SUPPLY

With its historically low correlation to the broader stock market, it’s no surprise that people have turned to fine wine as investment during difficult economic times. As uncertainty and recession fears stalk the economy, what are the bid trends that will affect the wine as an investment market in 2024?

It seems certain that interest rates have peaked, with JP Morgan suggesting that global core inflation will “remain sticky at around 3% in 2024.” When compared with the International Monetary Fund’s (IMF) forecasted 4.5% late last year, it’s a positive sign that the price of goods and services is coming under control.

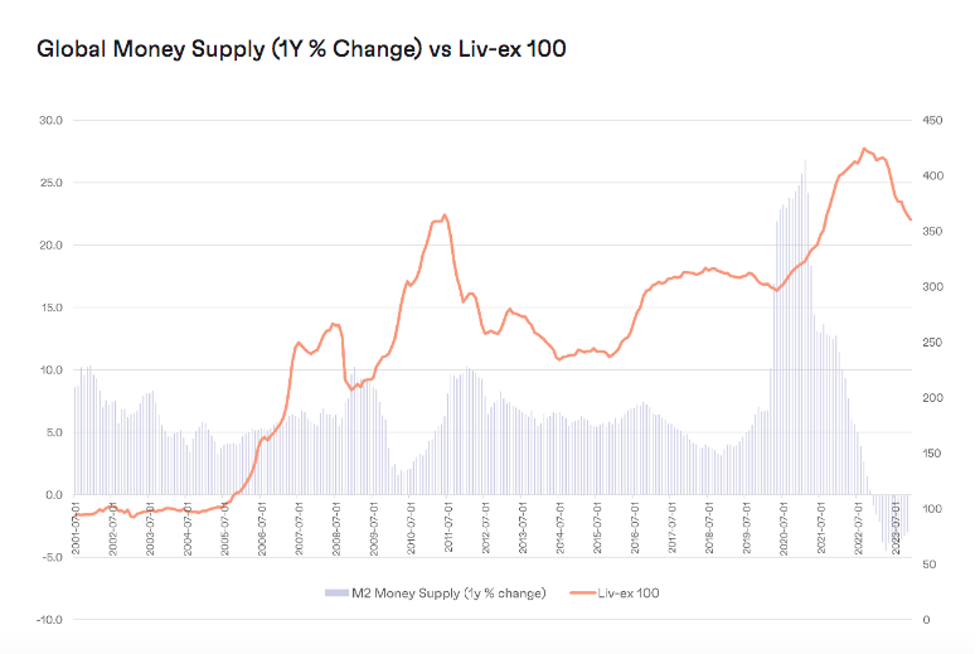

But why is all this important? Well, the cheaper that money is in terms of interest rates on capital, the higher the global money supply. And, the higher the global money supply, the higher the demand for wine.

Source: Wine Academy

A superb article from Wine Academy highlights the clear correlation between Money Supply and the Liv-ex 100 wines. It also underlines how the general investment market lags behind monetary policy.

So, their take is that the market is still dealing with the effects of high interest rates, and still could throughout H2 2024. However, after that, it could see an uptick and rally to finish out the year strongly.

2. A BUYER’S MARKET

Let’s give credence to the Wine Academies thesis that the market is lagging about 9 months behind monetary policy and mid 2024 is where we will finally notice a rise in wine prices. Does that mean that the best gains will be found in the summer? Well, it’s not quite that simple.

For starters, the market won’t suddenly leap into life in the summer of 2024. It will involve a gradual run-up that is consistent with inflation’s slow climb down from its 2023 peaks.

The next thing to consider is that the declines witnessed in 2023 have slowed down. Q4 2023 saw the market show some early signs of stability, so this isn’t a catching-a-falling knife scenario.

What it comes down to is this. The overall trends suggest the market will recover. Precisely when (and how) is difficult to predict. So, it’s actually an excellent time to enter the market at a reasonable price. A few months in the red as you wait for your investment to tick up could look like a small price to pay for getting some interesting bottles at the sort of prices you need to turn a profit.

3. SUSTAINABILITY

From antique cars to handbags to diamonds to watches, luxury investments are becoming more sustainable. More recently, wine production has become part of that broader discussion.

In part, it’s due to consumer preferences for more environmentally-friendly products. However, what’s going on is far more prescriptive.

In recent years, companies have been sounding the horn about their commitment to the environment. Quite often, they make it part of their “values” or “mission,” and there is at least some evidence that consumers suggest it is a factor in their purchasing decisions.

However, what is less talked about is how environmental, social, and governance (ESG) ratings affect suppliers’ access to distributors and, more pertinently, access to credit. What’s more, US and EU wineries that want to access government grants could see their business model screened for ESG criteria.

Like any sustainability initiative, companies will respond at different rates and degrees of compliance. If you’re thinking about investing in a particular estate, it might be worth diversifying your portfolio to feature some of the ESG leaders in the space.

4. THE NEW WAVE

The annual 2023 Gérard Basset Global Fine Wine Report came out at the end of the year. A full 85% of fine wine market players are either positive or very positive about 2024. Experts survey, ranging from producers to distributors to Master Sommeliers, cited the strength and demand for fine wine plus the growing level of fine wine expertise among consumers as reasons to be cheerful.

However, another positive the survey noted was the emergence of the next generation of winemakers. These producers are taking a different approach with an emphasis on artisanal wine from less well-known regions, including New World wines.

Many of these new producers are catering to a younger, modern palette. Some of the characteristics are lower alcohol and calorific wines, with less oak and tannins. What’s more, there is a trend toward organic, low-impact production, and environmentally-friendly packaging.

How these products are marketed is different, too. Without the history and prestige that fine wine can call upon, these new players are embracing digital marketing and storytelling techniques to appeal to a younger generation. A limited-run vintage from the right estate could become one of the classics of tomorrow. Investors should watch this space with interest.

WINE MARKET INVESTMENT OPPORTUNITIES IN 2024

What are the big opportunities that Wine investment firms and collectors are getting excited about in 2024? Let’s take a look.

1. TIMING THE BOTTOM

Wine investment, just like any type of speculation, benefits from a long-term approach. Markets fluctuate in response to news, trends, and macroeconomic events. As the investment maxim goes, “time in the market is better than timing the market.”

That said, if you’re looking for opportunities, a declining market does offer you the chance to “buy low and sell high.” With prices hitting 2021 levels and below, we could be looking at the bottom. Getting in at a discount and taking a five or ten-year view could be the right play.

2. DIVERSIFICATION

Fine wine as an investment is already a diversification strategy. The sector’s traditionally low correlation to the equity market makes it a good hedge against market disruption. However, in 2024, it will be equally important to diversify your wine investment portfolio, particularly if you’re looking for double-digit returns.

The price decline of recent years means that rare, high-cost bottles have rarely been this affordable. The other thing to remember is that these bottles have declined at a slower rate than newer and less prestigious wines.

So, this might be a time to branch out and add a few big-name bottles to your portfolio.

3. AN UNEVEN BOUNCE

The likelihood of the market bouncing back to 2022 heights is remote, at least for now. However, even getting semi-close to these levels could be considered a fantastic year. The most likely situation is that some wines and regions will rebound stronger than others. Or, to put it another way, it’s going to be something like a stock-pickers market.

Liv-Ex, widely considered to be the fine wine stock market, offers investors a way to evaluate bottles by region. It looks at the number of bids for fine wines and compares them to the number of offers to get a bid-to-offer ratio. A tight ratio means more demand and a high ratio means less demand.

Data at the end of 2023 shows how some of the most popular regions are holding up. The bid-to-offer ratios are as follows:

- Bordeaux = 1:2

- Champagne = 1:4

- Italy = 1:5

- Burgundy = 1.9

These data represent a broad flight to quality, with Bordeaux wines still exhibiting strong demand. Of course, within these broad categories, there is more granular data down to individual vineyards, wines, or years of production. So, ensure detailed research is a pillar of your wine investment strategy.

RECAP: IS WINE COLLECTING FOR INVESTMENT

A GOOD CHOICE IN 2024?

Wine collecting for investment is never a certainty. As the last few years have shown, there will be ups and downs. However, if we look at the market over periods like five years or over the course of decades, then performance is predictable and positive.

The big question for investors is whether 2024 will get worse or better? The big factors to consider are:

- If interest rates drop, wine collecting will bounce back

- Buying quality and thinking long-term will bring results

- Take discounts while you can in early 2024

- Value is out there in new, emerging estates

- Diversify your wine portfolio where possible

FINE WINE AS INVESTMENT: ALTERNATIVE METHODS

Of course, finding a wine to collect for investment can take several different forms. You don’t need your own cellar or storage, and in many situations, investors won’t ever see the bottles that they invest in.

Let’s explore some of the alternative methods to help you invest in the market.

1. ARE WINE INVESTMENT COMPANIES A GOOD IDEA IN 2024?

There are a number of fine wine investment firms that provide an alternative way to speculate within the space. They can be a good option because they make the process of buying and selling wine fine very accessible. However, where possible, work with fine wine investment firms with a history in making returns and always thinking about the fees involved.

2. WINE INVESTMENT FUNDS

Professionally-managed wine investment funds offer an interesting alternative to speculating on fine wines. These funds help you select, source, store, and sell your investment wine. Perhaps most importantly, they lend expertise and deep market analysis, which can make all the difference, especially in a stock picker’s market.

The downsides are things like storage, service, and performance fees, which can eat into your profits. So, while a fund might have a strong historical performance of 10%, you need to think carefully before you give up that equity for the sake of convenience.

3. WINE BONDS

Wine bonds have a lot of similarities with fine wind funds, except they offer fixed returns over set periods, such as 5 to 10 years. In ways, they work similarly to government bonds but with slightly higher returns.

The right bond firm will know the best wine to invest in and make the process very hands-off. With a range of entry points and the promise of diversification within the wine investment space, bonds have plenty of upsides. Again, don’t forget to factor in management fees when evaluating bonds offered by wine investment companies.

4. THE WINE STOCK MARKET

Another way that you can engage in wine investment is through the stock market itself. Of course, if you take this approach, you won’t be buying bottles or cases of wine. Instead, you’ll be investing in wine companies that benefit from global sales of the grab. For example, you could take a piece of luxury-conglomerate LVMH Moët Hennessy Louis Vuitton and take advantage of the growth of the champagne market.

Similarly, you could get involved by buying a Wine-related Exchange Traded Fund (EFT). For example, you could follow the Liv-ex Fine Wine 100 Index throughout The Wine Fund (KWUS). Similarly, the iShares Global Luxury Goods ETF (IGLX) could give you some exposure to the market.

5. FRACTIONAL WINE OWNERSHIP

Fraction wine ownership is a great well for people to invest in top-tier wines with full ownership. It’s a great option for someone looking for lower entry points, storage, and access to rare and elite wines.

New platforms are emerging to offer these services. However, it will take a while for them to build up their track record, develop trust, and grow in popularity enough to offer an easy exit from your trade. Proceed with caution.

6. WINE DERIVATIVES

Wine derivatives are complex, risky, and occasionally illiquid ways to invest in wine. Just like financial derivatives, they allow you to speculate on the price of wine without owning a bottle. For example, you can take out Options contracts, or Futures contracts or even Exchange Traded Notes.

Vint and Liv-Ex both offer derivative trading on their platforms. The upside for traders is diversification and the ability to leverage their trades. But these are complex financial instruments with high fees and big risks attached. Again, it’s not something to wade into with a lot of knowledge of both the financial and wine markets.

Most expensive wines ever sold at auction as of 2024

Notable auctioneers such as Sotheby’s and Christie’s have their own dedicated branch for the subject, offering rare and desirable lots for sale with expert authentication. The numbers being reached before the gavel falls have shot up in recent years.

Below are but a few examples of bottles or cases sold at auction, notable for their price and/or their heritage.

1. The “Kingdoms” DOMAINE DE LA ROMANÉE-CONTI, N°1 METHUSELAH ASSORTMENT 1985 – – $1.02 million

Looking back, the most expensive bottle of wine sold at auction in 2020 was to a Swiss buyer for CHP 900,000, the equivalent of over $1 million. This “Kingdoms” by Baghera/wines star lot was the only one of its kind throughout the world and included a set of six large-format Methuselah (6L) bottles from Domaine de la Romanée-Conti.

These Domaines Prieuré-Roch wines were the focus of competitive bidding by the growing interest among the great enthusiasts and investors of Côte-de-Nuits terroirs. This niche product fetched more than double its estimated conservative value because of the high-quality and historical character of rare spirits and Chartreuse liqueurs.

2. THE SETTING 2019 GLASS SLIPPER VINEYARD CABERNET SAUVIGNON – $1 MILLION

A charity auction in New Orleans in 2021 saw an ultra-rare six-liter bottle of Cabernet Sauvignon go for an incredible price of $1 million. The bottle, produced by Californian company The Setting Wines, was part of a limited run of only 900 bottles. However, even with that rarity, few expected the Methuselah to fetch anything close to this price point.

Don Steiner, the successful bidder, should not expect to get his money back at resale. A standard-sized bottle of this kind will go for around $180. This record bid was about making a charitable donation for a good cause. The bottle was just a bonus.

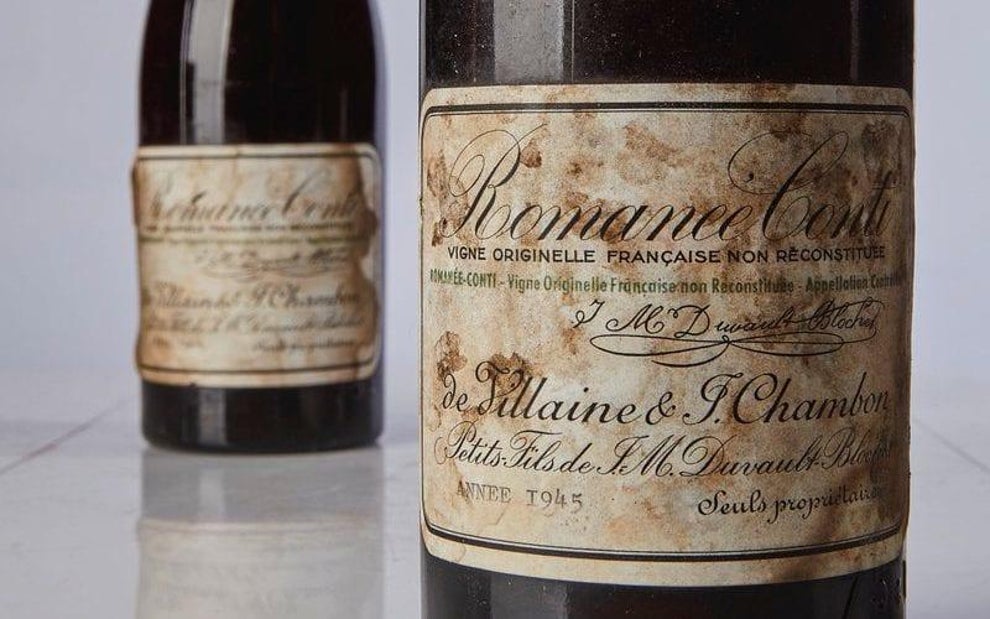

3. DRC 1945 Burgundy – $558,000

The 2018 Sotheby’s Wine auction saw the world record for a single bottle of wine being broken repeatedly, with this particular investment wine ultimately taking the top spot.

Domaine de la Romanee-Conti, a French estate with over seven centuries of experience, holds the reputation amongst collectors as being the best source of the world’s best wine as of 2024, and this bottle of 1945 vintage may very well be just that.

If you wish to pour yourself a glass of heritage and history, you may need some substantial capital to do so, as there are now only 600 bottles of this lot in existence.

image source: https://www.independent.co.uk/news/world/europe/wine-world-most-expensive-bottle-burgundy-1945-sothebys-auction-a8583326.html

4. 1992 SCREAMING EAGLE CABERNET SAUVIGNON – $500,000

Another Californian Cabernet Sauvignon, another record at a charity auction. This time, the buyer was Cisco Systems executive Chase Bailey.

Just like the 2019 bottle from The Setting, the fact that this was a charity auction led to a hugely inflated price. While this bottle is no slouch — the esteemed Robert Parker scored it a near-perfect 99 — a whole case retails today for at most $250,000. Indeed, a single bottle has sold for as “little” as $10,000 at Christie’s.

5. Château Mouton-Rothschild 1945 – $317,000

Château Mouton-Rothschild is one of the world’s best-known estates. It’s located close to Bordeaux in an area called Pauillac.

Easily one of the most famous bottles of wine in the world, it went for auction at Christie’s in London in 1997, resulting in a stunning price of over $300,000.

The iconic bottle has a “V” for victory, designed by Philippe Jullian in celebration of the Allied Forces’ winning World War 2. Of course, sentiment alone is not enough to make this win so celebrated. Wine critics consider the 1945 vintage to be one of the world’s greatest wines.

6. Château Cheval Blanc 1947 – $300,000

In 2010, A 6-liter bottle of Château Cheval Blanc 1947 was sold for over $300,000 at Christie’s Geneva. Robert Parker has scored the wine as extraordinary, but others have suggested that its rarity is the real causal factor in its price.

Château Cheval Blanc says that 1947 was a good summer for wine, but “fermentation was to prove difficult.” The result is a bottle more akin to a vintage port. However, it’s almost impossible to get your hands on, and because wine collectors are unlikely to drink a $300,000 bottle, this vintage is about the thrill of the case and the opportunity to own a wine that is so rare that it has been described as mythical in some circles.

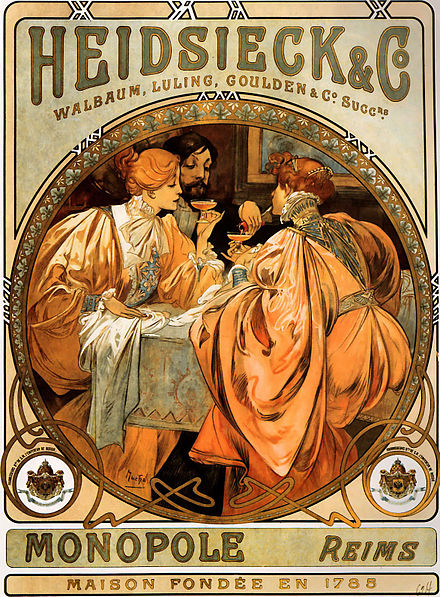

7. 1907 Heidsieck & Co Monopole Champagne ‘Diamant Bleu’ – c£200,000

This bottle is an example of how a wine’s story can also add to its investment allure.

Recovered from the seafloor over five decades after the ship it was on board was sunk by a German U-Boat, this champagne sold at 228,000 euros at a Moscow auction.

Hopefully, the taste of this rare wine hasn’t been tainted by unwanted notes of saltwater.

8. Chateau Margaux 1787 – c£180,000

Coming from a renowned French vineyard and being over two centuries old, it is no surprise that this bottle of Chateau Margaux commanded 191,000 euros at auction.

But it transpires that age and quality are not the only reasons this wine bottle was so highly sought after by investors. It had in fact been owned by Thomas Jefferson, third president of the fledgeling United States, which elevated it beyond a ‘regular’ bottle of 1787 Chateau Margaux.

Unfortunately, the bottle was dropped not long after it was bought at auction.

9. Six bottle case of DRC Romanée-Conti 1996 – $134,750

Cases are also an option for the prospective wine investor.

If you’re a wine enthusiast, and the idea of buying and reselling without tasting the sublimity of what you’ve purchased feels almost sacrilegious, then a case might be the best investment solution. Here, you can buy 6 bottles in a single fell swoop, savor and enjoy one and sell the 5 individually. It might not be the most efficient strategy from a wine investment perspective, but sometimes you’ve simply got to treat yourself.

Of course, much like the other areas of investment, there are many strata when it comes to buying and selling wine. Six-figure single bottles are the upper echelon, and there are still plenty of desirable yet moderately priced wines that can still be a valuable addition to your investment portfolio.

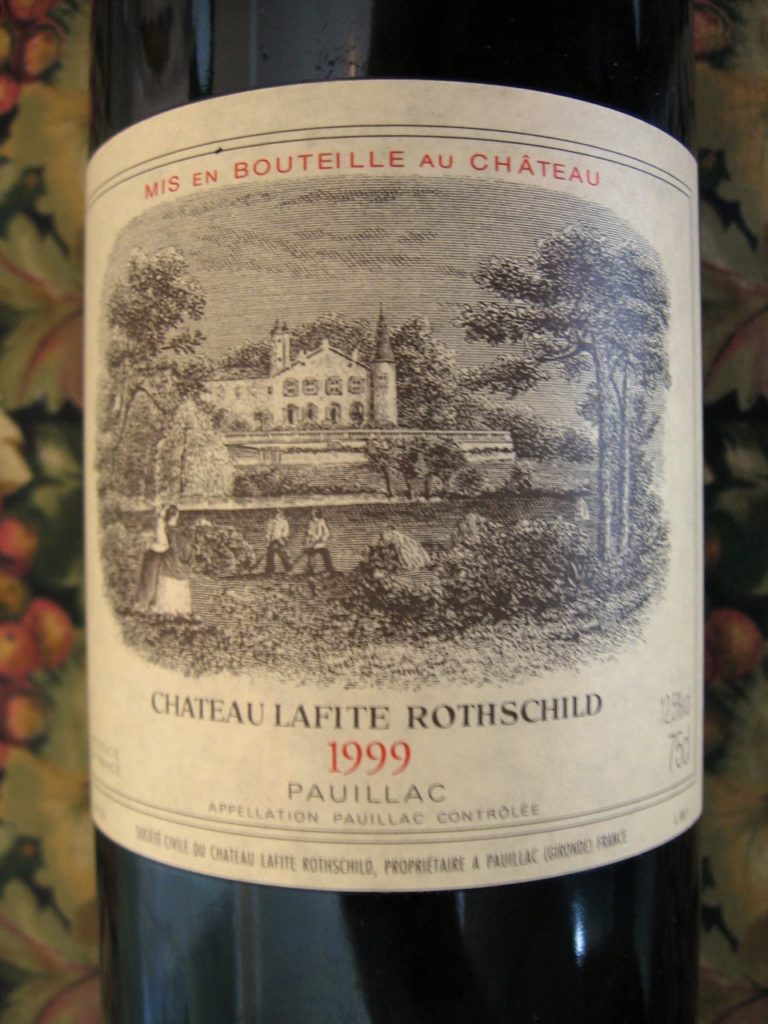

Some Chateau Lafite-Rothschilds can be had for as low as £2,000 and there are plenty of online auctions that can help give you an insight into the market itself. Equally, you might think you have to wait decades to make any return on your wine investment – in fact, experts have advised that between 5-10 years is the optimum length of time for reselling.

Wine prices at auction have increased roughly threefold over the last decade, and this upward trend is likely to continue as more people are drawn in by the relative security of this investment market and the inherent charm that comes with trading objects with a great deal of history. A good wine can help elevate a meal to new heights, but a truly great wine could benefit you and your investment portfolio hugely.

Investing in wines…A £20M COLLECTION case study

An overseas businessman has been given a loan against his collection of investment fine wines, valued at £20m. The businessman, who chose to remain unnamed, sought the capital in order to invest in new business interests.

The £20m loan was brokered by Octavian Vaults, a company specializing in the storage of fine wine. Their well-guarded vaults are located 100 feet below the Wiltshire hills and are made from solid Bath stone.

According to Octavian’s website, this allows the temperature and light to be kept at an optimum level. One of their cellars was used during the second world war to store ammunition and was likely built to be deep underground so as to avoid enemy shelling.

FAMOUS FANS

Octavian’s private vault is home to bottles of fine wine belonging to 10,000 private collectors and investors.

Rumored to be among them are West End and Broadway composer Lord Lloyd Webber, and former Manchester United manager Sir Alex Ferguson, who was known to enjoy drinking fine wine with his opposite number after matches during his time at the north-west football club.

In order to provide the capital – which Octavian could not provide alone – they worked alongside Emigrant Bank Fine Art Finance, to whom they had to provide certification that the investment wine was genuine. They also had to provide proof that the wine would be kept in satisfactory condition.

It’s thought that the loan provided was equivalent to most of the wine’s investment value.

What are the advantages of investing in fine wine?

It may be puzzling to those who aren’t particularly interested in wine as to why anyone would pay so much for a glass container of fermented grapes, but there are plenty of level-headed reasons as to why it could be a safe and considered investment decision.

For one thing, much like the other previously mentioned alternative investments, the fine wine market is resilient to economic storms thanks to the niche nature of the pastime combined with the passion of dedicated collectors.

Collecting fine wine is a fairly practical and low-maintenance pastime as well. Hanging fine art requires wall-space and special lighting to minimize fading; watches need cleaning and routine services; classic cars need automotive pampering and a garage that isn’t filled with old paint-cans and spiderwebs.

But even with the best investment wines, all you need is somewhere dry and cool to store it safely (a cellar is the most obvious choice) and then you simply leave it to accumulate value, worry-free.

The inherent rarity that comes with a vintage case or bottle is one of the strongest aspects of what makes fine wine investment desirable both to a buyer and a seller.

If you had £200,000 to invest in something, and you bought, say, a Ferrari 488 or a McLaren 720S, then you’ve got yourself a fantastic supercar, but you’ve also bought something that will one day be superseded by a newer, more advanced model.

But a 1937 magnum of Bordeaux that is one of a thousand simply remains what it is, and won’t be relegated to obscurity by a newer, better 1937 magnum.

What do the Best wines to invest

in 2024 have in common?

1. Place of origin

As you will probably know, there are wines with protected places of origin, the most famously sparkling white wine from the Champagne region of France.

In the same vein, the estate or vineyard where the grapes were grown and subsequently fermented and bottled is key when it comes to the best wine investment opportunities in 2024.

Prestigious wineries and chateaus have accrued reputation and thus desirability over time, such as Musigny, Romanee-Conti, Chambertin, etc. Researching the history and appeal of a winemaker is an advisable step before confirming your decisions on the best wines to invest in 2024, and beyond.

2. Age

Everyone knows the phrase ‘aged like a fine wine’ and naturally, it applies to wine investment. Many of the most valuable single bottles ever sold at auction were first pressed and bottled pre-1900, with some being as old as 1789. Of course, age alone does not generate worth, but it is a key factor in determining the best wines to invest in 2024.

Age is an important factor when assessing a bottle of wine for investment purposes.

Best wines to invest in 2024 do not have to be old to be valuable, and a bottle being old does not automatically make it good in its own right, but it’s certainly a handy indicator of value. Investment in wine that is decades old may well be highly valuable, it’s just that you have to take other factors into account.

Additionally, you need to consider the time taken to make the wine, not just the year of the harvest that’s printed on the label. Investment wine that has been aged for 6 years in the barrel is likely to be far more valuable than one that’s been aged for a few months. Do some research on your particular bottle, and you should be able to find out how long it has aged.

3. Provenance

Proof of origin and the history of the bottle/case. Auctioneers will of course make sure that all fine wine has the proper certification and proof of authenticity, but this is still something to bear in mind when buying or selling wine as an investment. Fakery and deception are the nemeses of any collector, and keeping your guard up is key.

A closer look at the factors that determine

the best wine investments in 2024

Here are a number of factors to look out for when you’re trying to assess the value of your wine investment in 2024. It can take years of studying and expertise to put a precise figure on a bottle, but by following this checklist you’ll certainly be able to figure out if your bottle is fine wine or a dud.

4. Region

The first – and easiest – thing to do when assessing the best wines to invest in 2024 is, is to look at the region in which the wine was produced. Was it harvested in a well-established wine region or a less developed wine region?

Wine from a country such as France, Italy, or Spain is far more likely to be valuable than a wine from the USA, or European countries with less of a long-standing wine tradition, like Germany.

You then need to look closer and figure out which region within the country of origin your investment wine was harvested in. Certain regions are well known as producers of premier wine, and this will affect the investment value of your bottle.

However, don’t make the mistake of assuming that your bottle of investment wine is valuable just because it’s French, Italian, or Spanish; wine harvested in one of the premier wine-growing regions in California could well be more valuable than a lesser French wine.

5. Terroir

Terroir is a word that is overused by wine connoisseurs and investors, and one that often confuses those not in the know.

So what does it mean?

Terroir is the French word for ‘land,’ and it refers to three main factors; climate, soil, and terrain. These three factors affect the way grapes grow, and can therefore have an impact on the overall flavor of the end product.

Climates being cool or warm can affect the sugar levels of grapes, with a hotter climate linked to high sugar content. There are hundreds of soil types that can affect the flavor of a wine, and while it may take some research, this is worth learning about if you are serious about investing in wine.

Finally, the terrain can have an impact; grapes grown at different altitudes, and at differing distances from a body of water can both have an impact on how your investment wine tastes.

Another factor people may be referring to when they use the word terroir is the winemaking tradition of the region.

So how can this be used to value a bottle of wine, and determine the best wine to invest in 2024?

Wines from certain terroirs around the world are more valuable than others, so do some research on the wine’s terroir and see if it’s particularly notable. If it is, your wine could be quite valuable.

6. Year

In the past, you’ve probably heard a wine connoisseur refer to a wine as being from a ‘good year’.

What does this mean exactly?

What they’re referring to is the year the grapes were harvested. As with any agriculture, the yield of a harvest can fluctuate. There can be bad years, with not enough sun or moisture, and the grapes can turn out badly as a result. And then there are good years, where all of the factors affecting harvest come together to result in perfect grapes, and a great tasting wine.

Of course, this wildly differs by region; a good year in Bordeaux may have been a terrible year in Tuscany.

Do your research and figure out if your investment wine was part of a good harvest. If it was, you’re more likely to get a good price for it.

7. Appellation

From Vin De Table (table wine) at the lowest of the rungs of classification right through to Vin de Pays and Appellation d’Origine Vin Délimité de Qualité Supérieure (AOVDQS) there are many varieties within these prevalent classifications. These distinctions carry great reverence and influence popularity due to their superiority.

Worldwide these investment wines are seeing new areas of demand in the global market and are adjusting accordingly. These new pools of wealth are exactly that, impressively lucrative, dynamic, and contemporary demographics of a new rich.

Forbes Magazine cites the dynamic shifts in the ever-changing distribution of wealth and the prevalence of high-net-worth individuals worldwide as being more concentrated in China than in previous years. In fact:

‘There are 63,500 ultra-high net worth individuals with assets of more than 100 million yuan’ Forbes.com

The world’s most expensive fine wines from Bordeaux, Burgundy, Rhône, Champagne, and Spain have seen phenomenal growth in sales in Hong-Kong, the gateway to China and to new Asian markets, as a result of this re-distribution of wealth.

The risks of investing in fine wine

1. Faux Fine Wine

There are always risks in investing large sums of capital in liquid assets, from the scams of the early 2000’s to modern sophisticated counterfeiters.

It is not difficult to see why – during the massive fine wine investment boom of the early 2000’s – that the draw to wine counterfeiters was so high. Landbank fraud was on the rise, the metropolitan police reported in this period. In a Telegraph article from 2011, it was said that

“Fine wine investment fraud is the latest in a long list of scams and frauds costing UK consumers over £38bn a year, according to the National Fraud Authority.”Matthew Wall |Saturday 25th June 2011

2. Top Ten Wine Frauds in History

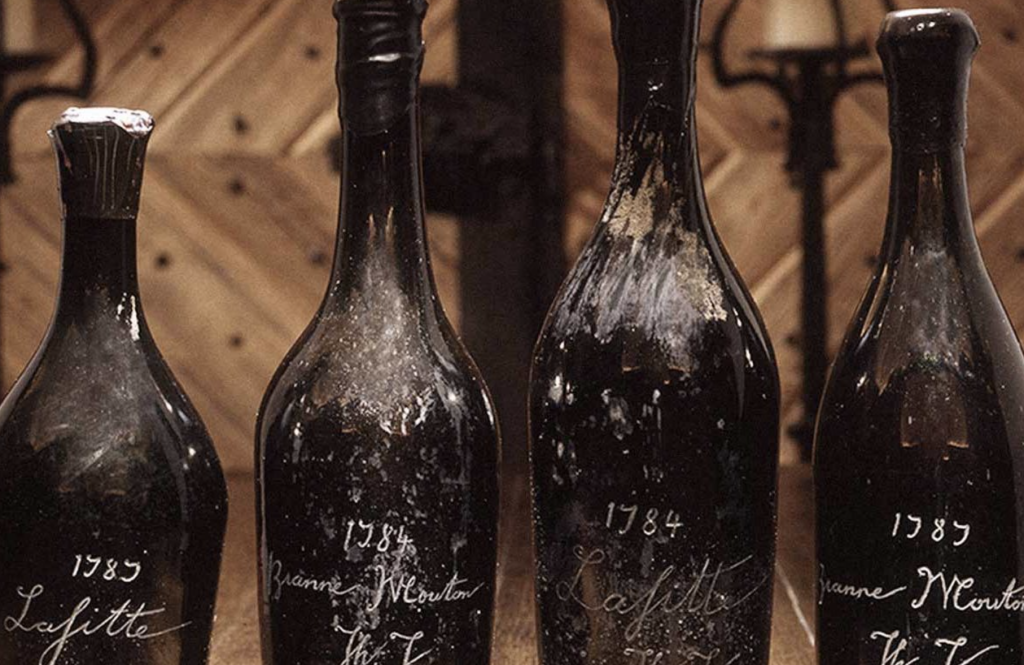

1. The Jefferson Bottles (1985 – present)

In April 1985, German music promoter and wine collector Hardy Rodenstock claimed he knew of an 18th-century home in Paris that exposed a hidden cellar during demolition that contained close to 100 bottles of wine – Over 20 of these engraved with the initials ‘Th.J’.

Later that year, Christie’s-in-London auctioned an old bottle engraved with the scribbled notation ‘1987, Lafite, Th.J’ claiming it belonged to a collection of old French wines owned by the third U.S president, Thomas Jefferson.

Kickstarting a buzz in the rarified wine world, collectors from all over the world rushed to obtain one or more of the remaining engraved Th.J. bottles. At the end of the 1980s, Bill Koch paid 500,000 dollars for four bottles.

Decades later and fast forward to 2005, The Boston Museum of Fine Arts prepared an exhibit displaying Koch’s eclectic collection of rare wines and asked for the provenances of the Jefferson bottle.

Koch hired a former FBI agent who sent an investigator to Jefferson’s estate to research the connection between himself and the discovered bottles. As a meticulous record keeper, it was concluded to be doubtful Jefferson ever ordered or owned the vintage wine as no records revealed any evidence.

2. Brunello di Montalcino – 2008

Brunello is the name of a particular strain of Sangiovese and by law, Brunello di Montalcino should be 100% Sangiovese grapes grown in the Montalcino area and aged a minimum of 5 years before it’s released for sale.

As discovered in the 2008 wine scandal coined ‘Brunellogate’, producers of the bottles were liberally adultering their supposedly 100% Sangiovese wines with more inferior grapes of other varieties such as locally grown Merlot and wine from a southern Italian region, Puglia. Adding grapes from other regions stretched out the wine, making it darker in colour, bigger in body, richer in tasting and more appealing to international palates.

3. Red Bicyclette – 2010

Supposedly a Pinot Noir from the Languedoc region, Red Bicyclette was distributed by E&J Gallo in the US, selling around 18 million bottles. When the French authorities investigated it was discovered that only a fraction of the wine was a Pinot Noir and the main bulk was created from Merlot and Syrah.

Fines were given totalling about 180,000 euros and sentencing was limited to financial considerations due to the fact no injury or personal harm was caused.

4. Georges Duboeuf– 2005

In a trial that rocked the French wine world, wine icon George Deboeuf was fined 30,000 euros for fraud concerning the origin and quality of wines after it was uncovered about 300,000 bottles of wine produced by his estate were illegally blended with lower-grade wine rather than a single source.

Deboeuf denied any responsibility, blamed it on human error and stated that less than 200,000 litres out of the 270 million litres he produced overall were affected and none of these had been sold to consumers around the world.

5. Austria and antifreeze– 1985

In 1985 the antifreeze scandal came began to circulate after it was discovered that during production several Austrian wineries added diethylene glycol into their wines to make them sweeter and more full-bodied.

An investigation was launched after one of the producers accounted for unusually large quantities of diethylene glycol on his tax return and German labs confirmed its usage.

Several winemakers were arrested and millions of bottles were destroyed. The scandal had a detrimental effect on the wine industry throughout Austria, with exports only returning to pre-1985 levels in 2001, nearly two decades later.

6. Italian methanol scandal – 1986

In 1986 one year after the antifreeze scandal, a fraudulent Italian winemaker mixed lethal levels of methanol into his wine. 23 people lost their lives as a result and over 90 people were taken to hospital after being poisoned. Giovanni Cirvegna and his son Daniele were charged with multiple accounts of manslaughter.

The scandal rocked the Italian wine industry and led the government to tighten up its acts and enforce stricter control measures over wine production.

7. Dishonest blending practices in Bordeaux – 19th century

Wines from Bordeaux would often be blended with stronger ones from the Rhone, Spain or the Languedoc region to improve both colour and strength. Across several centuries it was common for winemakers to use a blend of wines from the ‘high country’ and it was the additions of wines from outside of the region that sent Bordeaux’s wine popularity soaring.

In 1905 reports of dark and heady wine in barrels from North Africa and the Midi were being shipped to the UK, bearing the names of their respective chateaux and stating to be 100% Bordeaux. This shared a likeness to the mixing of North African reds to bulk out concentration, colour and alcohol content.

8. Champagne investment scam– 1997

During the late 1990s the night before the Millennium, a call went out stating there isn’t enough Champagne left in the world to celebrate what was expected to be the ‘biggest party for a thousand years’.

To the rescue came Lee Rosser, Craig dean and Julian Blee, three men from a Paris-based wine investment business who persuaded people to purchase the vintage wine from 1996 and 1997, Champagne Lantz, for £30 per bottle.

Sales amounted to over £4.5 million, promising their clients they could secure their purchased bottles of champagne in a bond before selling them at pre-arranged auctions before the Millennium, achieving a yearly increase of 35% on the original investment.

The downfall was that the auctions did not exist, and it was both a ruse and a sales tactic to increase sales. Not only had no auctions been arranged, but the bottles of champagne were also worth significantly less than claimed, leaving no profits to be made at all.

9. Rhône producer accused by daughter– 2010

One of Châteauneuf-du-Pape’s largest producers, Guy Arnaud, split his 51-hectare estate into thirds, with three equal shares divided between his three daughters. Each daughter expected to receive 17ha, valued at £500,000 per hectare when he passed. Two out of the three daughters agreed with the deal but the third daughter, Carole Perveyrie-Arnaud, requested her plot immediately, suing Arnaud for €200,000.

When the land was not given to her before her father’s death she acted out of anger and frustration claiming that her father was breaking appellation laws and using a blend of wines from other origins.

No evidence was found to support this claim and the case was later dropped.

10. Fake Mont Tauch in China– 2007 – 2010

Between the years 2007 and 2010 it is estimated that around 400,000 bottles of what appeared to be Mont Tauch Fitou were imported and sold at surprisingly low prices that weren’t in line with its usual retail value.

This news reached Mont Tauch’s sales team and the team were alerted due to being the sole distributor of the brand across Asia. After analysis by Mont Tauch, it was confirmed the wine was probably lower quality wine purchased in bulk from South America in well-forged packaging that tasted ‘radically inferior’.

Although trademarked, the bottles and labels were good forgeries.

Source: The Drinks Business

“

Fine Wine and Bribery

Luxury is about aspirations and the dream armada of consumable items. This is including fine wine and spirits for these newly rich, elites and government forces of the Far East. The corrupt landscape of these political arenas has been widely known for a long time. In a news article Good Cat Cigarettes – retailing at an equivalent of $889 in China – were amongst other luxury items that were suspected of being used to bribe officials on a large scale, as early as 2012!

Then in 2013 this all came to a grinding hault as new Chinese President Xi Jinping sharply cracked down on gifting as part of his broader anti-corruption drive, and wine (and spirits) sales began to fall.

“A market force no one seemed to have predicted had pierced the bubble. Gifts were an ostentatious aspect of the corruption Xi sought to root out — if someone did you a political favour, or bent a rule, a gift was given and received. Many believe that the wines given were often never even consumed, and that fact didn’t really seem to matter. With no more gifts, the market began to slow. As demand currently remains soft, prices sit near five-year lows, with many of the finest wines still off nearly 40% from their gifting-induced peaks in 2011” VinePair.Com

Emerging Fine wine geographical areas…

California Is Where The “Interesting” Fine Wine Is At

James Simpson, Master of Wine

The Golden State of California produces approximately 90% of the wine made in the whole of the USA and is home to some of the most loved wines in the world as well as introducing some of the best wines to invest in 2024. A combination of tight supply and low production levels means the top vintages of distinguished labels can achieve Burgundian values.

Like burgundy, fine wine investment in 2024 is made up of low production levels and tight supply, with each vintage aimed at continuing to satisfy a loyal US market, as well as a flourishing market overseas for wine collectors and wine investors to achieve high returns from their fine wine investment.

A global marketplace for the wine trade, Liv-ex, stated on its California 50 index, that the average price performance of US investment wines experienced a 34% uplift in the year to 31st March 2022 which was above the general market trend of 23.2%, and the amount of Californian wines traded on the Liv-ex has increased by almost 480% over the last five years achieving record figures of 504 by the end of 2021, illustrating the perfect market for some of the best wines to invest in 2024.

High-quality Californian wines and heightened demand have led to rising prices and booming figures that show both impressive and steady wine investment returns. This showcases the importance of the right time and product for fine wine investment in 2024 to add to the growing portfolio of collectors across the world.

Speaking during Pol Roger’s showing of the wines from California’s Robert Sinskey’s Vineyards and many others, James Simpson stated as early as 2016 that California is the place for fine wine investment.

Indeed, in 2016, having just added Robert Sinskey Vineyards, and Staglin Family Vineyard (both based in California), to their portfolio, Simpson pointed very early that trends in the UK were pointing toward Californian wines. According to him, Californian wines are crucial to the continued success of Pol Roger UK.

Pol Roger is a notable producer of champagne, producing at least 110,000 cases annually. Dating all the way back to the 1860’s, Great Britain has always been the premier export market for Champagne Pol Roger.

In a statement, he said, “We think that California is the next big thing in terms of fine wine and the exchange rate is good and the UK wine trade is looking for something posh to sell, and we’re not excited about Australia, South America or South Africa.”

He noted that these additions to their portfolio were not necessarily needed but rather the companies wanted “international respectability”. He said that Staglin is likely to “open the doors” in “uber posh American restaurants.”

Although not revealing anything, Simpson also said that Pol Roger UK was looking at the time to take on another name from California. Whilst he adamantly said that California is the place to be for fine wines, as he thinks, “[…] California is more interesting than anywhere else in the New World,” he also mentioned Oregon as a place of interest for Pinot Noir.

2. Chile

As the world’s fourth largest exporter of wine, Chilean wine has seen something of a revolution over the past two decades, and the country is quickly growing in reputation for its quality world-class reds, from Cabernet Sauvignon, Merlot and Syrah.

In recent years, through mapping and analysis of the soils before planting, the quality and value of Chilean wines have risen and the country has developed a specialty in the production of high-quality noble and fine wines, leading to larger wine investment returns.

The Chilean wine industry has ambitious objectives, mainly to increase its export of wines with a higher case price.

3. Argentina

With a rich wine history, Argentina is most known for producing some of the world’s best Malbecs and it is the meticulous approach of its winemakers and growing confidence in their craft that has propelled Argentinian wine into the world of fine wine at an impressive rate, leading to some of the most lucrative fine wine investment in 2024.

Argentinian wine has seen a shift over the past decade in both its quality and style as its producers focus on its freshness, fruit expression and length, translating into some of the most distinctive and best wines to invest in 2024.

Impact of the Ukraine War on Investment Wines

Just as wine drinkers saw hope of a return to normalcy, Russia invaded Ukraine and upended a massive section of the wine industry. Several wine labels come from Eastern and Central European countries, including some notable brands from Ukraine.

The Russian invasion impacted all neighboring countries because of a shortage of required materials and shipment disruptions. Since the Russian onslaught targeted a major port on the Black Sea and made it all but impossible for shippers to pick up or drop off cargo. The trade disruption reverberated through several countries as Ukraine failed to deliver necessary materials, including glass and grain.

Closed ports mean additional travel time to reach an open one, and with higher fuel costs it’s driving up prices on all goods. The impact on the supply chain translates to inflated prices per bottle.

Some shortages can be attributed to repurposing materials for weapons, primarily glass. Edible materials were necessary for feeding the people and filling in for the lost supplies as Ukranians evacuated their homes, farms, and factories. Additionally, the Ukranians had to stop working on wine production to fight for their homes.

Vineyards in neighboring countries also halted or slowed production to support Ukranian refugees. For example, Château Purcari is a Moldovian winery in the southeast part of the nation. Located on the Ukranian border, this award-winning winery with hundreds of international accommodations, set aside the business to support Ukraine.

Thankfully, Château Purcari has not experienced any physical damage or other effects due to the war. However, the winery opened its doors to thousands of Ukrainian refugees providing shelter, food, water, blankets, and more.

Aside from supporting Ukranian refugees, bordering vineyards lost out on tourism funding they relied on to support their wine-making. Just as people started to travel in a post-pandemic world, Russia essentially cut off tourism in Eastern Europe.

Digging deeper, fine wine sales to these countries impacts the global market. Though there’s less competition with Russian wine connoisseurs, other countries are weighing in on both sides of the conflict. The geopolticial ramifications are complicated and making it even more challenging to obtain some wines.

Valuation of your fine wine investments

If you’re looking to pawn fine wines, contact our multi-award-winning pawn shop in Mayfair, London today. Our Blenheim Street shop is based in the heart of Mayfair. Appointments can be made, but are not 100% necessary; we’re always happy to take walk-ins.

We look forward to seeing you – and your fine wines – very soon. Some of the wine we loan against includes Chateau Petrus, Chateau Margaux, Chateau Lafite and Chateau Mouton to name just a few.

We hope you enjoyed our article on the best wines to invest in in 2024 and encourage you to read further on our comprehensive blog!

This post is also available in:

Français (French)

Deutsch (German)

Italiano (Italian)

Português (Portuguese (Portugal))

Español (Spanish)

Български (Bulgarian)

简体中文 (Chinese (Simplified))

繁體中文 (Chinese (Traditional))

hrvatski (Croatian)

Čeština (Czech)

Dansk (Danish)

Nederlands (Dutch)

हिन्दी (Hindi)

Magyar (Hungarian)

Latviešu (Latvian)

polski (Polish)

Português (Portuguese (Brazil))

Română (Romanian)

Русский (Russian)

Slovenčina (Slovak)

Slovenščina (Slovenian)

Svenska (Swedish)

Türkçe (Turkish)

Українська (Ukrainian)

Albanian

Հայերեն (Armenian)

Eesti (Estonian)

Suomi (Finnish)

Ελληνικά (Greek)

Íslenska (Icelandic)

Indonesia (Indonesian)

日本語 (Japanese)

한국어 (Korean)

Lietuvių (Lithuanian)

Norsk bokmål (Norwegian Bokmål)

српски (Serbian)

Tamil

The broadening fine wine investment market reflects demand as investors seek to diversify fine wine collections to optimise growth as trends shift focus by region, vintage and brand. Critics’ scores and drinking windows are an important consideration ensuring a quality portfolio positioned for changes in supply and demand. Where previous years have seen the Power 100 dominated by the Bordeaux First Growths and more latterly Burgundy, 2020 witnessed the broadest Top 5 composition with a marked absence of Bordeaux.