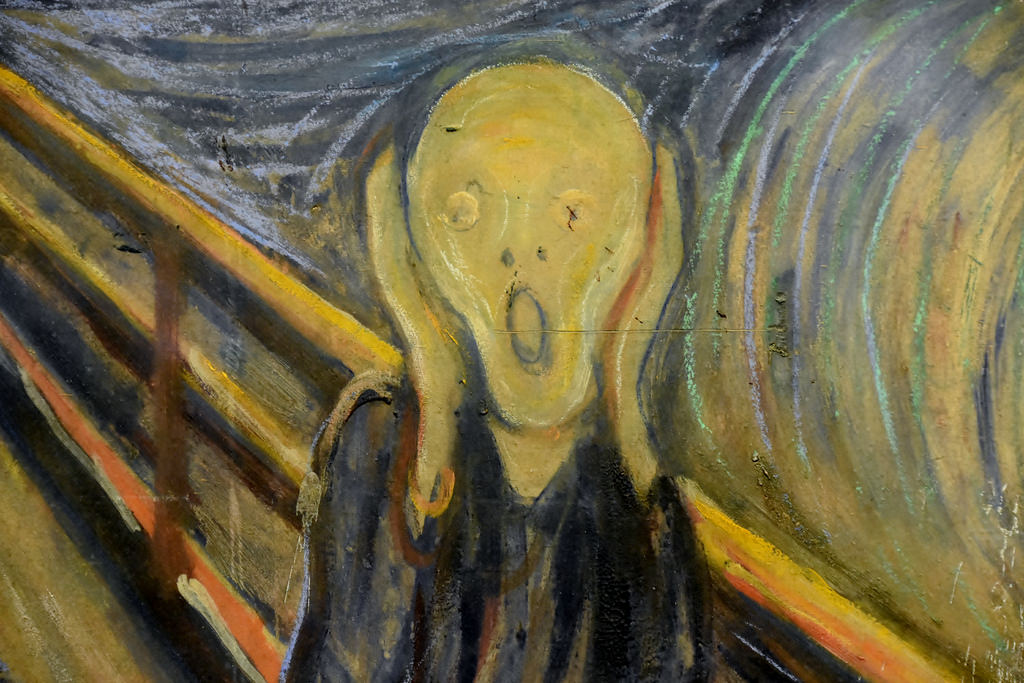

Fine art is an expression of creativity which can take those who appreciate it on a journey through time, emotion and thought. Prolific artists such as Van Gogh, Monet, Picasso, Dali and Michelangelo are household names because art can be appreciated by anyone.

When you look at a painting and consider the craftsmanship that went into it, what the artist was feeling and thinking and how different life was back when it was created, it can be overwhelming.

So if you are lucky enough to own a piece of fine art then you must appreciate it’s emotive nature.

![]()

Why pawn fine art?

Pawnbrokers provide a fast, easy way to get hold of a loan against artworks in your possession. In addition, because these kinds of loans are secured with assets, no credit checks are required.

Pawning is a convenient alternative to selling off the artwork. If you need a quick injection of cash but don’t want to see the back of that precious Lichtenstein, the solution may be to pawn your fine art.

There is also a certain flexibility involved in pawning, meaning that in many situations if you repay the loan early, you can claim the painting back ahead of schedule – perfect for those situations when Uncle Monty is coming to visit and looking forward to seeing that priceless Monet painting he bought you for a wedding present.

Listen to our podcast episode on everything you need to know when valuing art and paintings for a fair loan:

How to value Fine art

Pawnbrokers often have excellent in-house valuation teams who will handle this for you. But if there is little known about the pawnbroker’s track record, it can be worth getting an independent valuation done so that you have a rough indication of how much your artwork is worth.

Ensure that you choose an expert with relevant academic or professional qualifications, and ask to see their certificates if in doubt. What kind of professional regulations are they bound by?

A top drawer valuation can sometimes take more than one day, so you will need to consider the practicalities of leaving your artwork overnight – does the valuer have secure storage, how is it kept, and will it be insured? Also find out how they intend to keep in touch with you during this process.

For those looking to pawn fine art, there are many different things to think about. The aesthetic or sentimental value of a painting will need to be considered against its financial value, and the benefits for you as a seller which will come from art loans or sales. For this reason, it’s useful to get your fine art valued by a professional, who will have been training in this discipline for many years.

However, there are some ways you can value art yourself, which will prepare you for the evaluation of an art expert and help you to avoid expectations which are either too high or too low. This will serve you well when looking to pawn fine art.

Identify the artist

If you are looking to pawn fine art, and would like to value it, the first and most important step is to find out which artist the piece you are considering was created by. There’s no need to be disheartened if you don’t recognise the name yourself, as art is valuable to many different collectors and art enthusiasts for many different reasons.

Once you’ve determined who the piece was created by, you can move on to the next step.

Research the context of the painting

Through online research, and considering the style of the painting you are looking at against others, it’s likely you’ll be able to gauge roughly when the piece was created during the artist’s career. Often, those pieces which were created earlier in the artist’s life are likely to be more valuable, as they will be more daring or unique visually.

Another important thing to research is the output of the artist who created the piece. If the artist didn’t create much work, it’s less likely that you’ll be able to get a high value for your piece, as the value of fine art is often determined by how prolific the artist themselves was.

It’s also important to consider the reputation of the artist, and whether they are/were well-known or unknown. This can be determined by researching whether there have ever been exhibitions of their work in galleries or museums, and finding out if they have been mentioned in publications such as books and magazines.

By further researching the artist, you should also be able to determine whether or not the piece you have in your possession is representative of their wider body of work. To be of a higher value, the painting, sculpture or other art which you are valuing should epitomise the style of the artist.

If the piece you are looking at seems to deviate from their normal style, it is likely to be less valuable, as this is of less interest to a collector who is aiming for cohesion within their personal art collection.

Find out if the fine art you are valuing has duplicates

Often, an artist will create more than one version of the same piece.

This could be for many reasons – whether they are simply pleased with the outcome of the painting and feel they will be able to sell more than one copy, or perhaps the duplicate is just one version in an effort to create the perfect final piece. Due to the rules of supply and demand, if your painting is not one-of-a-kind, it’s less likely it will be given a high value.

Remember that size matters

It is often, but not always the case, that larger pieces of art will receive a higher valuation, due to the fact that they are simply more difficult to complete. If the fine art you’re valuing is a large painting or sculpture, it’s likely that it will have a slightly higher value, and you’ll therefore be able to pawn your painting for more money.

Investigate the ownership history of the piece

Even if the painting you are valuing has been gathering dust in your family for generations, it’s still possible that it was once owned by someone within the highest echelons of society. Perhaps it once hung in the halls of a member of the royal family, or maybe the piece was favoured by another renowned artist.

Through very thorough internet research, you might be able to determine whether or not the fine art you are aiming to finance was ever owned by someone notable, which will increase its value significantly. Even if not, you’ll still need to have some form of provenance to hand. This gives the buyer confidence that e is buying an authentic piece.

Consider its condition

Cleaning up a piece of art is likely to increase its value by up to 20%. If the piece you are looking at has any water damage, rips or any other form of damage, this will affect its value.

For this reason, it’s well worth establishing how much value your piece would have were it in perfect condition first, and then investing in a thorough makeover from a quality art restoration business.

Even if a painting has lost its original vibrancy, this will mean it is considered ‘damaged’, so although there might not be any immediately obvious superficial damages to the painting, it’s a good idea to look into how the colour of paint etc. should look, based upon the time the piece was created.

Therefore, you may want to look into restoration if you are looking to pawn fine art.

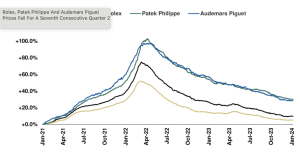

Know your market

The market for fine art is one of the most unpredictable and fluctuating markets out there – so it’s important to do your research when trying to achieve an accurate valuation.

Again, it’s important to consider supply and demand. For example, if a large amount of this particular artist’s work has recently been discovered and has just entered the market, your piece is likely to be worth less. However, if your piece is the first painting by this particular artist to be placed on the market in a long time, or if a new group of buyers has recently entered the market, you’ll be able to get a far higher price when you pawn fine art.

It’s also crucial to look at recent market trends, for example, whether or not there has been a recent price rise for art from a certain region of the world due to interior design or fashion trends.

How to maximise value

Next comes the process of taking the art to a pawnbroker who will perform their own valuation – the same considerations as above apply when the valuation is underway. There are a couple of things that you can do to ensure that you get the best possible value from a pawnbroker.

First and foremost, if you have a certificate of provenance or other evidence of authenticity, ensure you bring this to show it to the pawnbroker. Any doubts that they may have about the genuine nature of the artwork will have an adverse effect on the value you will get from your loan, so make sure you bring whatever paperwork you have.

Also useful is your independent valuation. The pawnbroker may or may not concur with this evaluation, but as a qualified second opinion, it could sway them. And of course, make sure that you compare the value the pawnbroker quotes with the one you have from your independent expert. Based on this evaluation, it may be time to shop around and see if another pawnbroker offers a better deal.

Typically pawnbrokers will base their assessment on what they consider to be the second-hand market value of the item. In some instances, they may also consult external specialists to verify the item’s value, particularly in cases of higher-value items.

How to research value…what makes a painting worth more than $100m?

Qualified experts will provide evaluations at a price, and it can be worthwhile doing your own research too. The website Findartinfo.com compares your artwork with the auction sale prices of similar artworks to provide a rough estimate of its value, and Artcult.com provides a compendium of rough price ranges for various known artists.

Following the sale of a painting by Jean-Michel Basquiat for $110.5m at auction, Ian Welsh discusses the growing trend of art pieces selling for nine figure sums, and what factors can drive this kind of sale.

When Jean-Michel Basquiat’s untitled painting of a skull sold for $110.5m at Sotheby’s in Manhattan, the art world was once again left debating just what it is that makes high-end art sell for millions. Brooklyn-born Basquiat’s “Untitled” (1982), was bought by Japanese entrepreneur Yusaku Maezawa. After a tense 10 minute bidding war, Maezawa’s $110.5m bid made the painting the highest-selling piece by an American artist in history.

The super-rich like Maezawa seem to be keener than ever to get their hands on top-end art, and in the last few years nine figure sums have become less and less unheard of. But what factors ensure that a painting sells for this kind of money?

The reputation of the artist

While art has a reputation for being esoteric, there are some artists whose names alone can push the financial values of their wares into the hundreds of millions. As with any market, established, trusted names can have a big impact on the sale price of an asset.

Works by household names like Leonardo da Vinci have sold for stunning amounts, with the Renaissance polymath’s “Salvator Mundi” fetching $127.5m in 2013. Even that was beaten by Rembrandt’s “Pendant portraits” in 2013, after a member of the Rothschild banking family sold it to a consortium of museums for a tidy $180m.

The recognition factor, while not enough to guarantee a sale, is undoubtedly a valuable asset.

Age of the piece

As with all markets, scarcity has the power to drive up prices. Buyers are more likely to want to snap something up if they know that this is their only chance to get hold of a piece by a certain artist, and this motive may well have been at work with Maezawa’s purchase – Basquiat’s painting hadn’t been on the market since the 1980s, so the chance to get hold of it must have seemed like a once-in-a-lifetime opportunity.

While for more recent pieces it tends to be artist inactivity that causes values to skyrocket, several other expensive sales fall into this category purely because the piece is so old.

Take “The Card Players”, by Cézanne, which sold to the State of Qatar for a whopping $259m in 2011. Cézanne produced the piece in the 1890s, which made it well over a century old by the time it came to be auctioned.

Gustav Klimt’s “Portrait of Adele Bloch-Bauer I”, which was painted just after the turn of the century in 1907, is another prime example of long legacies pushing up market values.

Like fine wines – and, perhaps, most luxury goods – the market clearly believes that art only gets better with age. While buyers may take lots of other factors into consideration before they commit themselves, it is clear that the older and rarer the piece, the more likely it is to have a higher investment value.

State of the art market

Wider conditions have an impact on any industry’s fortunes, and only the entrepreneurially-minded risk-takers of the collector universe will be happy to shell out their cash in an uncertain, jumpy art market.

For that reason, it’s no coincidence that three of the four most expensive pieces of artwork ever sold all got their new owners in the same year. 2015 was a fabulous year for top-end sales, with works by de Kooning (most expensive ever), Gauguin (second-most) and Pollock (fourth-most) all selling within eight months.

The wider art market saw sales of $16.1bn that year, suggesting that like any savvy purchaser, the clever collector will only move when the time is right. While 2016 saw a drop in sales compared to the year before, no doubt the market will pick up once again as collector confidence comes back in future years.

The day of the auction

Yet even a big name, conditions of undersupply and a buoyant art market can’t beat the battle of wills between several rich, determined bidders.

Sometimes, all it takes to push a sale into astronomical, record-breaking figures is to have a bidding war on the floor of the auction house when the big day rolls around. Pablo Picasso’s 1955 “Les Femmes d’Alger (Version ‘O’)” smashed all known auction records in 2015, when five potential buyers bettered each other’s offers in nerve-wracking increments of $1m before it sold to a Qatari politician for $179.4m.

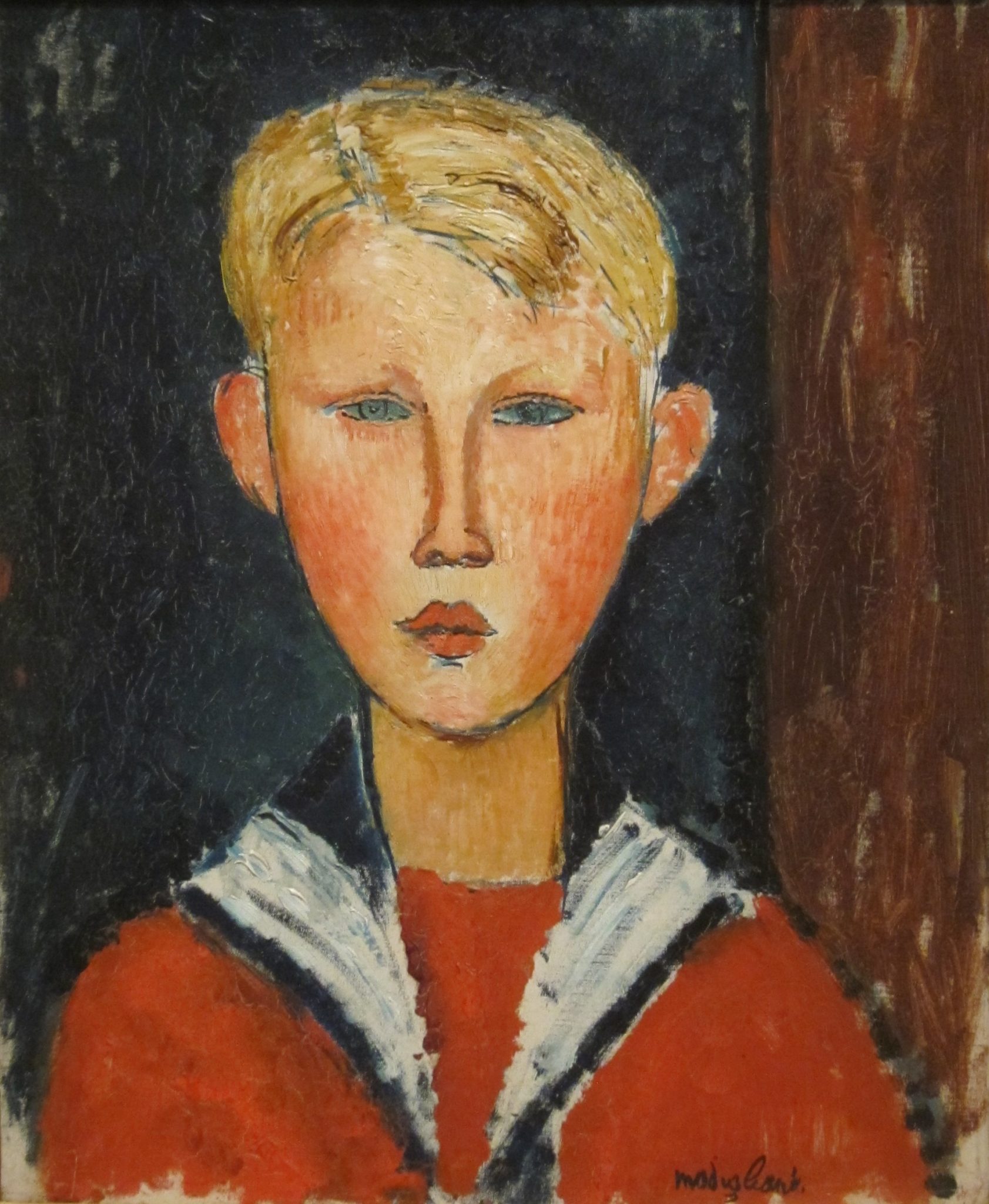

A similar, fast-escalating bidding war took place in 2015 with the sale of the original version of Modigliani’s famous canvas “Nu couché”. As with the Picasso, it sold on the floor of Christie’s in New York, but this time with six bidders all competing and driving up the price. It took just nine minutes for the most committed buyer, Chinese collector Liu Yiqian, to triumph.

Overall, there is no guaranteed key to selling a piece at a high price and beating the coveted $100m mark. But the history of the market shows that, with a lot of skill and a bit of luck, it’s getting easier and easier to predict which high-end works will be the next to enter the record books of the art world.

How to ensure the authenticity of your fine art piece

Imagine this: you place the beautiful (and expensive) piece of fine art you have invested in up for sale. Your hopes of life changing profit are dashed as you are told that it is, in fact, a fake. Conversely, imagine this: that old painting or sculpture that you have always enjoyed the look of, but never considered to be financially valuable is seen by an expert, and you are given an eye-wateringly high valuation. Book yourself a holiday quick!

The above two situations, although at opposite ends of the spectrum, are in fact incredibly common, and highlight the need to ensure the authenticity of your fine art piece, something that the team at New Bond Street Pawnbrokers in London have been helping with since the turn of the century.

So, with this in mind, just why is ensuring authenticity so important and what are the top tips for doing so?

The importance of authentication

Recent years have seen a marked increase in the appetite of fine art collectors, with billionaires from China and Russia, alongside newly emerging markets, adding to the already crowded market for fine art and antiquities. Alongside this increase in demand, there has been a steady increase in prices, something that New Bond Street Pawnbrokers have borne witness to.

However, with this increase in demand and prices, there inevitably comes an increase in forgeries and fakes. As a result, it is increasingly important to ensure that any pieces of art – whether paintings or sculptures – are authenticated and have sufficient provenance behind them to assuage any fears of fakery, and to ensure that these pieces are insured for – or bought for – the appropriate monetary amount.

A case study in provenance: Huanghuali Drum Stools

If you’re buying in the secondary market, that is, buying something second hand, you need to be confident that the item you’re buying is legitimate. Because of this, it’s absolutely vital that you secure some kind of proof of the item’s legitimacy and quality. This proof is called provenance, and it takes many forms; it could be a receipt of sale, proof of display in a museum, proof of sale at auction, or any other document that points towards the item’s validity.

Recently we worked on a pair of 19th Century Huanghuali drum stools, putting them up for sale as part of Chinese Week at Sothebys. Huanghuali – known as ‘fragrant rosewood’ in English – was used to create furniture during the 17-19th centuries in China. Fragrant rosewood has been threatened by centuries of deforestation, so pieces made from this material are becoming increasingly rare. Couple this with their association with a famous, long-passed era in Chinese history, and it’s easy to see why these pieces of furniture

These particular barrel form stools were created during the Qing Dynasty, the last Chinese dynasty before China became a Republic in 1912, with an elected president rather than an emperor. However, these stools differ greatly from other examples of Huanghuali furniture from that period.

A proven seller

Rare Huanghuali furniture is a proven seller at auction, with plenty of pieces having gone down at well in top auction houses in recent years. In 2015, Christies in New York oversaw the sale of a Huanghuali square box-form stool from the 17th Century for $269,000 (£217,000). This piece just went to show that – as long as the seller has all the necessary provenance documentation – an authentic Huanghuali piece can perform very well at auction.

In order to guarantee that the stools would be listed by Sothebys, we needed to provide a series of provenance documents, reassuring the auction house that the item is legitimate and worthy of being listed in one of their prestigious sales. Seeing as the set of stools are legitimate, we were able to provide numerous provenance documents. We have documentation proving that both stools were part of a private collection in the 1940s, and part of a museum display in New York. In addition to this, we have various pieces of documentation proving the sale of the stools over the years.

Had we not been able to provide these documents, Sothebys may have chosen not to list the stools for auction. Provenance documentation is absolutely vital to this process; Sothebys don’t want to risk their reputation on a piece that could turn out to be counterfeit, and even if they did, it may put off potential buyers. This could lead to the item being burnt at auction, meaning its value will greatly decrease for a number of years.

Rarity matters

Apart from their excellent provenance, the form of the stools is among the rarest of their type ever produced. Not just this, but Huanghuali furniture is clearly in vogue at the moment, best evidenced by two sales of the same item in 2009 and 2015. A Huanghuali tiao’an (table) from the 17th/18th Century sold for £28,901 at auction in New York in 2009. The seller must have been left feeling sick in 2015 when the same piece sold in a Hong Kong auction for HK$7.8m, the equivalent of £220,000, a price increase of 785%.

But, to bring us back to the original point, this incredible sale, at such an increased price point on the one six years earlier, would not have been possible without ample provenance documentation. A sale of this magnitude is only possible with the correct provenance. Without it, it could fail to sell at auction, or even be rejected by an auction house and not even make it into a sale.

With this in mind here are our three top tips for ensuring the

authenticity of your fine art piece:

1. Establish the provenance of the piece

Provenance – a record of ownership of a work of art which can be used as a guide to authenticity – can take many forms, including (but not limited to) statements from the artist themselves, names of previous owners of the piece of art, a mention or illustration of the piece in a book or exhibition catalogue, or exhibition or gallery stickers attached to it.

Of course, there are many different forms, all of which help to increase the desirability and value of the artwork. However, those that would pass off fake artworks know this and often go to great lengths to ‘invent’ compelling records of provenance to help their cause.

This is a situation in which experts – such as those employed at New Bond Street Pawnbrokers – can help with, and fake accounts of provenance can be spotted fairly easily by those in the know.

2. Examining the ‘catalogue raisonné’ of the artist

A catalogue raisonné is the comprehensive listing of all the known output by a certain artist, providing detailed and important information about each piece, which may include titles, dimensions, dates, locations, and themes. Such compendiums are also likely to include a list of the current owner for each item – making it relatively simple in some cases to find a fake – as well as a loss of lost or destroyed works, or known fakes in circulation.

However, just as with the first point above, the catalogue raisonné can benefit the forger too, who may consult the compendium in order to determine what work to produce.

Again, this is where expertise such as that offered by New Bond Street Pawnbrokers can help. Their professional knowledge can make navigating this process a whole lot simpler.

3. Non-invasive examination of authenticity

If at all possible, you don’t want to be forced into invasive examinations of your piece of art. Such approaches, such as radiocarbon dating or peptide mass fingerprinting may be the most technologically advanced methods of authentication but are also the most expensive.

Instead, non-invasive approaches, such as the use of x-rays, optical microscopes, and UV fluorescence may be a viable option. Such approaches neither damage the potentially valuable piece of work, nor prove to be such a financial outlay when compared to invasive approaches.

Many regular or casual collectors of art will, of course, need assistance in setting up such procedures – again, come in and talk to us as New Bond Street Pawnbrokers for more information about authenticating your pieces!

Choosing a pawnbroker (our approach)

When you own a piece of rare and beautiful art, you may be faced with a dilemma.

The item will most likely have a high financial value, and could make you wealthy if you ever chose to sell it. But if it has high sentimental or aesthetic value for you, or you believe that it will one day be worth much more than it is today, you may be thinking twice about selling it on.

Here at New Bond Street Pawnbrokers, we can help you get some cash out of your item without having to sell it outright. By taking out a loan against your art, we will lend a certain amount of money, hold your art for the repayment period, and return it to you when you pay the cash and the interest back.

That way, you can unlock the value of the piece right now and get the cash you need to fund your business endeavour, home renovation or other project – while also keeping your art in the family for the future. Here’s how our process works, what our repayment terms are and what other items you can bring in to secure your loan against.

The valuation

Before any loan takes place, we’ll ask you to bring your artwork in for valuation – or if this isn’t practical, we’ll find another way to work out its worth like a home visit.

Following this, our expert team will assess the piece based on a number of different aspects, including how old the artwork is and what state it is in.

Once we’ve done that and you’ve provided the provenance for the piece in order to verify its authenticity, we’ll store your artwork in an exclusive art storage facility patronised by many major players on the London art scene – so it will always be kept safe during the period of the loan. This storage facility has had its services appointed by Her Majesty the Queen, which means it is one of the most prestigious in the city.

Paying off the loan

Once the valuation is completed, we’ll use this information to decide on how much your prospective loan will be. Everything is fully above board, so the contract we offer you will be regulated by the Financial Conduct Authority (FCA).

Usually, our loan periods have a maximum duration of seven months. We will be able to extend this if needed, so please speak to one of our team if this is an option you’d be interested in.

In the event that you would like to reduce your loan by paying back more of the cash than is required under your repayment plan, we are more than happy to accommodate this and will permit it without any cash penalties – giving you added flexibility when it comes to repayments.

The final stage of the process is the return of the item to you, which happens once the repayment has been made in full including interest.

Confidentiality and discretion

Nobody likes the world to know about their private financial affairs, and that’s why here at New Bond Street Pawnbrokers we always provide our clients with the utmost in discretion.

Firstly, we appreciate that personal finances are sometimes a sensitive matter. We put our clients’ needs first, so we will always make sure we respect your confidentiality.

Secondly, with our many years’ of experience in this industry we know that one whisper of gossip about a rare artwork, antique or other luxury item can be enough to change the markets and even the value of the piece in question. That happening wouldn’t be in our interest, and it wouldn’t be in yours either.

For that reason, we always maintain full confidentiality in all of our dealings with clients. You won’t need to worry about gossip or publicity when working with us.

A few final tips on pawning your paintings and fine art…

If you decide you wish to part with the treasure for others to enjoy, then be sure to follow these steps below to ensure you are getting the best price for your artwork:

1. Make sure you have all relevant documents

It is crucial that a pawnbroker can see evidence that the piece has not been tampered with or altered in any way. Fine art is worth so much more when the last brush strokes belonged to the artist themselves.

Also, if the work has been interfered with, it can make it so much more difficult for the broker to identify the artist.

Lastly, documents which show the artworks history can prove ownership which is important to ensure you are selling what is truly yours

2. Look after your artwork

It goes without saying that if you keep anything in good condition then it will hold it’s value, but this is highly important for fine art. Some artwork can be hundreds of years old causing it to be fragile and susceptible to damage. Temperatures are key to keeping your artwork in good order and the recommendations are during Winter 18-21ºC with a relative humidity of 40 to 45%, during Summer 21-24ºC with a relative humidity of 45 to 55% (as a general guide).

For different types of art, you should consider different things. Oil paintings can last for centuries if properly maintained but it needs to be noted that oils do yellow over time – you need to not worry about this as some even see the yellowing as an attractive trait.

The paint can also flake but there are professionals you can hire to coat the work in varnish to prevent this. Similarly, acrylics are more vulnerable to the build up of dust than an oil painting due to the chemical make up of the paint allowing it to dry quicker but softer. Whilst it doesn’t crack like oil paintings do, the dust build up and be an issue so the best course of action is to put the painting in a frame with a glass shield (which cannot come into contact with the painting but protects it).

So keep your artwork at room temperature but more than anything consider the humidity of the room. Do not ever clean a painting yourself, if you wish to lightly dust then make sure you only ever use a soft brush, such as an artist’s paintbrush that is made of goat’s hair as a conventional duster will scratch the surface.

Finally, do not hang near a ventilation system or heater.

3. Know your piece

It is imperative that you do your research and go to a broker who has a good understanding of the era of your artwork and how to identify it as genuine (this will also be helped by you providing your documents to prove the authenticity). It is like taking a Ferrari to a Maserati garage for a valuation – they are both cars but the broker would be trying to give you an estimate on a brand/model which they have no expertise in which throws doubt into their accuracy.

So endeavour to go to a broker you can trust to have the correct knowledge for your piece.

4. Gather quotes

Regardless of how good your first quote may be, do not just take the money and run. Take the time to look at other brokers and work out if everyone is singing from the same hymn sheet. Whilst the likelihood is that they will all say a similar amount, it is best to get at least 3 quotes to work out how much they vary and ensure you are getting the most money possible.

If you have a piece of valuable fine art and are in need of a little extra cash on a short-term basis, pawning it could turn out to be the perfect solution.

But if you’re venturing into this territory for the first time, the options can seem a little daunting. Here are a few tips that will help you get the most out of your pawn painting loan and avoid being ripped off.

New Bond Street Pawnbrokers offer credit against luxury art with minimal paperwork, plus specialist advice throughout. Some of the many artists we loan against include Andy Warhol , Bernard Buffet, Damien Hirst, David Hockney, Marc Chagall, Raoul Duffy, Sean Scully, Tom Wesselmann, Tracey Emin, Banksy, and Roy Lichtenstein to name just a few.