Assets we pawn against

Our promise to you

At New Bond Street Pawnbrokers, we believe loans should be simple. Whether you’re pawning fine jewellery, watches, or art, our fixed rate ensures you know exactly what to pay monthly. No surprise fluctuation, just straightforward loans on luxury items in the heart of Mayfair

We’re one of the most trusted and awarded Central London pawnbrokers. Our team of specialists provides accurate, auction-based valuations, ensuring your short-term loans against luxury assets reflect their value. We also partner with prestigious auction houses to ensure accurate appraisals of rare or specialised assets.

We’ve served our clients for 30 years from our Bond Street area pawnshop. During that time, we experienced growth and retained customers because we focused on fairness and transparency. Our luxury items loans are honest and upfront, setting us apart as the premier pawnbrokers in London.

We don’t require credit checks for loans against luxury assets. This stance ensures that our loans are swift, low-friction, and don’t affect your credit rating. Traditional financing is slow, cumbersome, and evasive. Our financing options are the opposite, which is why we’ve built strong relationships with our customers.

Time is one of the most undervalued assets in the financial world. When you borrow against luxury goods at our Mayfair pawnshop, we aim for quick same-day transfers that often arrive in your bank account in just two hours. When you need capital quickly, we’ve got you covered.

We provide flexibility when you pawn fine assets in our West End office. Our loans are set for between 2 and 7 months, but you can settle up at any time during that period. Best of all, we don’t charge early termination fees; all you have to do is pay the remaining interest on your loan.

As an FCA-regulated member of the National Pawnbrokers Association, we are committed to providing the highest standards of integrity and professionalism in the industry. We ensure that our pawn shop loans are clear, transparent, and work in your favour.

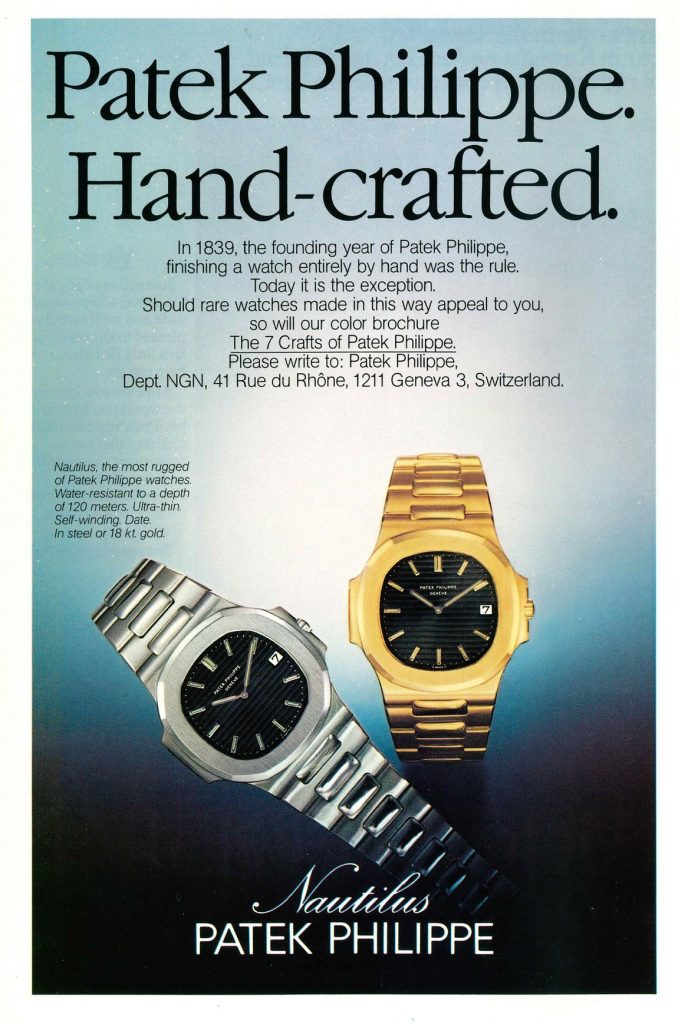

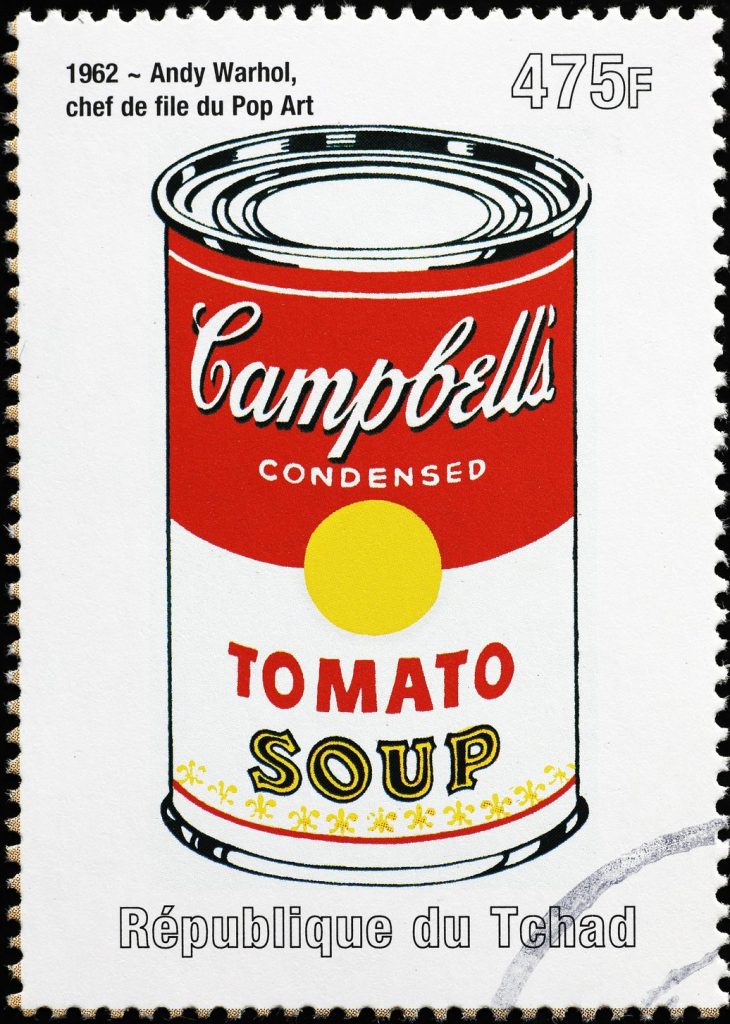

We pawn against a range of luxury assets from Rolex & Patek Philippe watches to jewellery from Cartier, Graff & Van Cleef & Arpels. So whether you have a fine wine, a rare book or an Andy Warhol painting, we can help you release some of that value.

Over

30

years experience

5%

fixed interest rate

Over

40

industry awards

Auction based estimates

The most awarded pawnbroker in the UK

With over 40 prestigious industry awards, a loyal customer base, and flawless reviews, our track record speaks for itself. We retain a customer base of high-net-worth individuals and famous names through competitive interest rates, discretion, trust, and impeccable service.

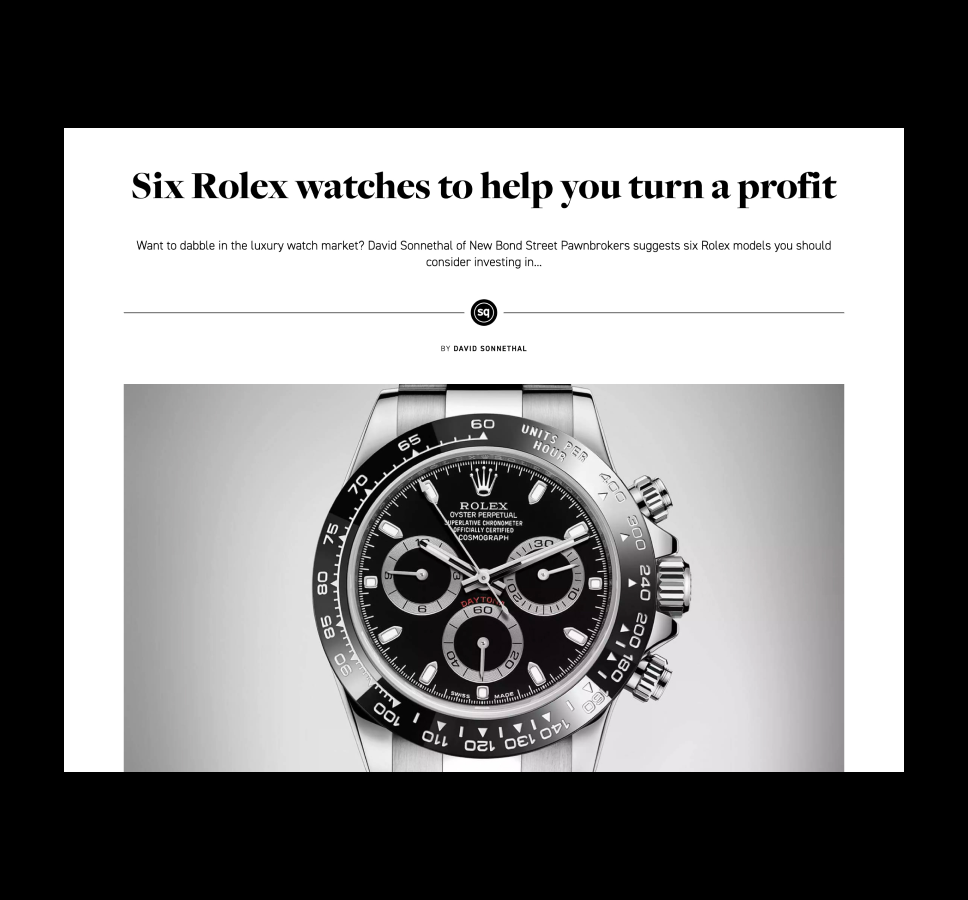

Headed by David Sonnethal, a four-time National Pawnbroker Association (NPA) award winner and familiar media figure, New Bond Street Pawnbrokers’ modern, forward-thinking approach to providing loans has not gone unnoticed by the public, the media, or trusted industry bodies.

Our reputation as an industry leader is cemented by awards that recognise the value that our store brings to customers. We took home the NPA Best Store of the Year award in 2019 and 2024 thanks to our commitment to innovation, adoption of technology, and a strong focus on teamwork, and the Employee of the Year NPA award in 2025. Additionally, the NPA highly commended us in 2022 and 2023 for our engaging social media work, which helped bring us closer to our customers.

New Bond Street Pawnbrokers also won “Best Website” and “Disruptive Business Model” at the UK Business Awards, thanks to our focus on customer-centric digital experiences. Finally, our win at the Experian Credit Awards demonstrates our dedication to responsible lending, customer care, and digital innovation in the luxury pawnbroking sector.

Transparency, fair lending practices, and user-friendly experiences are at the heart of what we do at New Bond Street Pawnbrokers. Reach out today to discover why we’re the most awarded pawn shop in the UK.

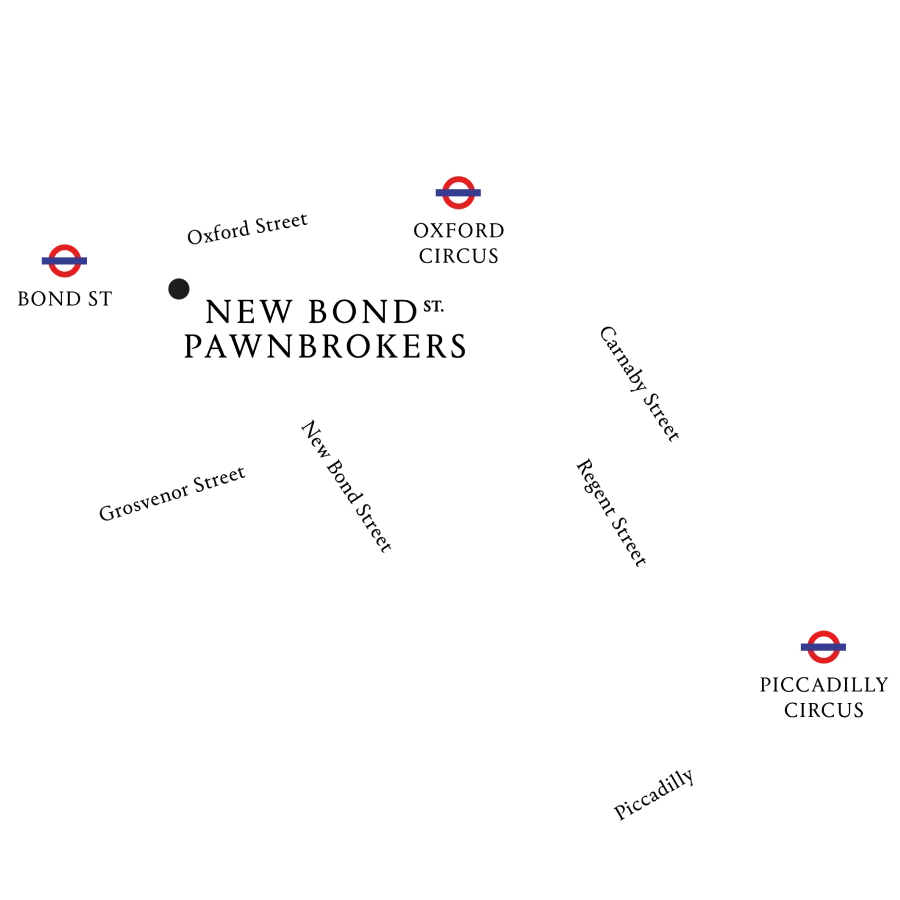

Situated in Mayfair, Central London

Modern, chic and comfortable, our Central London shop enables us to provide a secure, professional and relaxed environment for you to visit us.

Unlike most traditional pawnbroking stores, we have never retailed from our premises.

No appointment is necessary to meet our pawnbroking experts.

We look forward to welcoming you to New Bond Street Pawnbrokers soon.

Close to Bond St Station

We are located on a cobbled street just off New Bond Street in Mayfair, London.

A 2 minute walk from Bond Street tube station and only a 6 minute walk from Oxford Circus.

OPENING HOURS

Monday

Tuesday

Wednesday

Thursday

Friday

Saturday

Sunday

10AM – 5.30PM

10AM – 5.30PM

10AM – 5.30PM

10AM – 5.30PM

10AM – 5.30PM

Closed

Closed

5 Blenheim Street, Mayfair London W1S 1LD

020 7493 0385

[email protected]

Our Team

Susana Figueiredo

Manages the day to day running of the business

Mariana Vlad

Manages the day to day running of the business

Constantin Singureanu

Heads up our marketing and digital efforts

David Sonnenthal

The founder of New Bond Street Pawnbrokers

Featured in the Press

Our quality service, high standards, and innovative business practices have earned positive press coverage from a diverse set of media outlets such as The Times, The Telegraph, Time Out, Channel 4, The Spectator, and more.

FAQs

How much can I borrow against my luxury asset?

At New Bond Street Pawnbrokers, we offer competitive loans based on the current market value of your luxury asset. The specific loan amount largely depends on the item. Our expert appraisers evaluate watches, fine art, jewellery, and other luxury items individually to ensure you receive the maximum possible loan.

What papers do I need to pawn my assets to you?

The required documentation varies depending on the asset:

Watches: Certificate of authenticity, original box, service papers, and any additional original paperwork.

- Jewellery: Certificate of authenticity.

- Art: Certificate of provenance.

- Cars: Service documents, logbook, and provenance for classic or vintage vehicles.

- Diamonds: GIA certificate.

How does your valuation process work?

Our valuation process is thorough and tailored to each asset type:

Watches: We check authenticity, including paperwork, serial numbers, and holograms. We then value the watch against current auction prices and estimates.

Jewellery: We assess authenticity, condition, brand, and latest market values.

Art: We inspect the certificate of provenance and work closely with leading auction experts to determine fair market value.

Diamonds: Our in-house qualified GIA experts evaluate cut, colour, clarity, and carats using the latest GIA technology.

What luxury items do you lend against at New Bond Street Pawnbrokers?

As a premier Mayfair pawn shop, we offer loans against:

- Fine watches (e.g., Rolex, Patek Philippe).

- Fine art, prints, and photographs.

- Jewellery and diamonds.

- Classic and luxury cars.

- Antiques and collectables.

- And more.

How do you secure my assets?

We store all pawned items in our state-of-the-art, climate-controlled vaults, which have 24/7 security. This applies to watches, jewellery, diamonds, fine art, and other valuable items.

Do you charge any penalty fees for early repayment?

No. At our Mayfair, Central London pawn shop, you can repay your loan at any time without penalties or additional charges.

What happens if I can't repay my loan?

If you’re unable to repay the loan:

1. We’ll contact you to inform you of your contract expiration and discuss next steps.

2. You’ll have a 1-month grace period after the redemption date.

3. You can renew your loan agreement by paying the interest.

4. If you don’t extend or repay the loan, we may choose to recover the loan and interest by selling the asset.

Can you value my assets before I visit your shop?

Yes, we offer various options for valuations:

- In-store appointments are advisable, especially for high-value assets.

- Walk-ins are welcome at our New Bond Street location.

- We may arrange expert valuations for certain items like fine art or classic cars.

Can I renew my loan agreement?

Yes, you can renew your loan agreement by paying the interest. The same rate and terms as the initial contract will apply for the extension.

Can I pawn an item without papers?

Generally, provenance and paperwork are required. However, there are rare exceptions for very unique assets where it may be unrealistic to provide all documentation. In such cases, we arrange expert valuations with our leading auction house partners.

At New Bond Street Pawnbrokers, we’re committed to providing exceptional service for all your luxury asset lending needs. Our experienced team in the heart of Mayfair, London, is ready to assist you with pawning fine assets and luxury items loans.

How do you value a car?

At New Bond Street Pawnbrokers, we employ a comprehensive approach to valuing classic and luxury cars:

We consult with leading classic car experts to provide accurate valuations.

Our team researches recent auction results for similar vehicles to determine current market value.

We consider factors such as the car’s make, model, year, condition, rarity, and provenance.

For vintage or rare vehicles, we may arrange for specialised appraisals from industry-recognized authorities.

This meticulous process ensures that you receive a fair and competitive valuation for your luxury or classic car when seeking a loan from our Mayfair pawn shop.

How do you store or secure my watch?

At New Bond Street Pawnbrokers, we take the security of your valuable assets extremely seriously. For watches and other luxury items, we employ state-of-the-art storage and security measures:

- All pawned watches are stored in our high-security, climate-controlled vaults.

- Our facility is protected by advanced 24/7 surveillance systems.

- We utilise cutting-edge alarm systems to ensure the safety of your assets.

- Access to the secure storage areas is strictly limited to authorised personnel only.

- Your watch is fully insured while in our care.

Useful Guides

Top 8 Brands of Classic Cars You Can Loan Against at Luxury Pawn Shops

Listen to our podcast episode on the most popular brands of classic cars at high-end pawn shops: 1.…

Top 6 Brands of Fine Jewellery You can Loan Against at Luxury Pawn Shops

Listen to our podcast episode on the most popular luxury jewellery brands at high-end pawn shops: 1. Graff Diamond…

Top 15 Best Luxury Watches to Pawn in 2025

A luxury watch is more than just a stylish and sophisticated status symbol. Their craftsmanship, rarity, and eternal appeal mean…

Pawnbroking assets vs. Bank Loans – Myths & Realities

Bank loans allow the individual to borrow against their credit rating. A collateral loan, in contrast, allows the individual to…